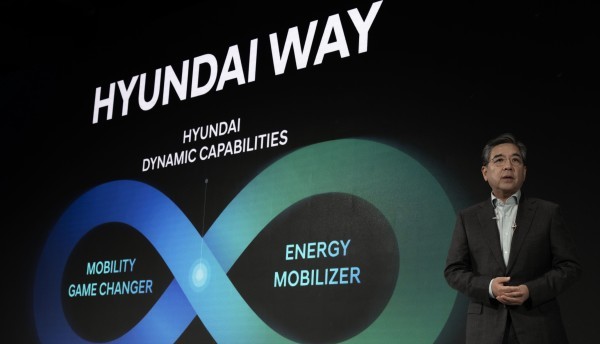

South Korean carmaker Hyundai Motor Co. plans to develop new hybrid powertrain technologies and deepen its future hybrid model pipeline in response to the decline in the global demand for battery-electric vehicles. At the 2024 CEO Investor Day held in Seoul on Aug. 28, Hyundai detailed its all-new ‘Hyundai Way’ strategy, which essentially entails responding to the dynamic market conditions.

The ‘Hyundai Way’ strategy is split into three focus areas – namely Hyundai Dynamic Capabilities, Mobility Game Changer and Energy Mobilizer. While Hyundai, now the third largest global automaker, has presented a roadmap detailing its future EV line up along with its battery strategy under the dynamic capabilities, it shared elaborated plans on the development of software defined vehicles (SDVs), electronic and electrical architecture and autonomous vehicle business under its mobility game changer focus area.

Under energy mobilizer, the carmaker plans to focus on the expansion of its expertise in the development of hydrogen fuel cell applications.

To fund product development in the mid- to long-term under the above-mentioned strategy, Hyundai aims to invest a total of KRW 120.5 trillion (close to $90 billion) between 2024 to 2033.

“This is KRW 11.1 trillion (about $8.3 billion) more than what was announced last year,” the carmaker said.

Of the total earmarked investment for the next decade, Hyundai aims to invest a bulk on research and development (R&D), which mildly underlines the quantum of uncertainty that the global automakers foresee amid the ongoing global transition to develop zero emission vehicles (ZEVs). Hyundai, which aims to continue offering a range of powertrains, including internal combustion engines (ICE), hybrids, plug-in hybrids, BEVs and hydrogen fuel cell vehicles (FCEVs), said that of the KRW120.5 trillion, it will invest 54.5 trillion Korean won on R&D, 51.6 trillion Korean won on capital expenditure and 14.4 trillion Korean won on strategic investments.

Strategic area wise, Hyundai plans to invest a total of 92.7 trillion Korean won under its dynamic capabilities strategy (to bolster its competitiveness in electrification technologies), 22.1 trillion won under its mobility game changer strategy (on advanced software, E/E architecture, autonomous driving, SDVs and robotics) and 5.7 trillion won under its energy mobilizer strategy (to develop hydrogen ecosystems and value chains).

On the front of hybrid technologies, Hyundai announced that it would double its current hybrid range from seven models to 14 models, expanding the hybrid propulsion technology beyond compact and midsize cars to small, large as well as luxury vehicles, including the model offerings under the premium Genesis brand.

Hyundai said that it plans to offer a hybrid variant for all models under the Genesis brand, excluding those that are exclusively electric (BEVs).

Further, the carmaker announced that it is developing the next-generation transmission mounted electric drive or TMED-II system, a form of parallel full hybrid system, and plans to integrate it into production vehicles starting from January 2025. The all-new TMED-II system will be an enhanced version of Hyundai’s existing hybrid system, being developed with an aim of significantly improving performance and fuel efficiency compared to the existing system.

Hyundai also disclosed that to counter the recent slowdown in EV demand, it is developing a new extended range electric vehicle (EREV) technology, which could help the carmaker in terms of maximizing the use of the existing engines as well as offer the benefits of an EV.

Under this head, the company said it has developed a unique new powertrain and power electronics (PT/PE) system that enables four-wheel drive with the application of two motors. The operation is powered solely by electricity, similar to EVs, with the engine being used only for battery charging, it said, adding that the technology aims to provide the customers with a responsive EV-like driving experience, thereby allowing them to naturally transition to EVs in the future when EV demand recovers.

Hyundai said it plans to commence the mass production of the new EREVs in North America and mainland China by the end of 2026, with sales commencing early 2027.

To this end, the carmaker plans to initially launch D-class SUV models positioned under the Hyundai and Genesis brands to meet the remaining demand for internal combustion engines (ICE), with a target of 80,000-plus units in North America.

Meanwhile in mainland China, Hyundai plans to roll out an EREV on an economical C-segment platform with a target of 30,000-plus units, thanks to the intense competition from the local players.

“The company aims to address the EV deceleration by expanding its hybrid and new EREV offerings and gradually increasing EV models by 2030 when a recovery in EV demand is expected. Hyundai Motor aims to build a full lineup of EVs, from affordable EVs to luxury and high-performance models, and launch 21 models by 2030 to provide consumers with various options,” Hyundai said in its press note.

With its planned new product developments, Hyundai aims to sell 1.33 million units of hybrid vehicles by 2028, hoping to record a growth of over 40% of its global sales plan from the previous year.

The development of hybrid technologies and products are in response to Hyundai’s expectations, where it anticipates a surge in the demand for hybrid vehicles, particularly in North America.

As a result, the carmaker plans to increase its hybrid vehicle volume to 690,000 units by 2030 in North American markets alone. That said, the company will tailor its hybrid sales expansion to meet the demand in each region, including South Korea and Europe.

On the production capacity side, Hyundai said it has secured a versatile production system and parts supply network, which will help it in making full use of its major global factories and introducing hybrid models. This approach will help the carmaker in saving costs and enhancing profitability.

To this end, Hyundai looks to manufacture hybrid vehicles at its upcoming Hyundai Motor Group Metaplant America (HMGMA) facility in Georgia, US, alongside its dedicated EV models, such as the Ioniq 5 and Ioniq 9, the three-row fully electric SUV.

“This strategy will allow the company to respond swiftly to the North American market, which currently faces a shortage of hybrid supply, and to enhance the operational efficiency of the factory,” Hyundai said.

On capacity building, Hyundai disclosed that it plans to add 1 million units of production capacity to sell 5.55 million vehicles globally by 2030. As part of this plan, the carmaker is targeting sales of two million EVs by 2030.

Of the one million capacity addition, production capacity of 500,000 units will come up across two key locations – at the upcoming US-based facility in Georgia, which is scheduled to open before time in 2024, and at its EV factory in Ulsan in South Korea, by 2026.

The company is also looking to establish a total capacity of one million units in India, an increasingly strategic market where it recently acquired a brownfield plant from General Motors (GM) near Pune.

Hyundai’s battery strategy

Hyundai disclosed it is looking to secure multiple battery technologies with an aim of strengthening its battery competitiveness, as well as advance battery safety technologies under its ‘dynamic capabilities’ strategy.

With plans to expedite the in-house development of next-generation batteries, including solid-state batteries, the carmaker is building a new battery research facility, which is scheduled to open at Hyundai Motor’s Uiwang Research Institute later this year. The upcoming battery R&D facility is part of Hyundai’s strategy to build its own in-house battery development capabilities, a move that is similar to the approach taken by the biggest global carmakers such as Toyota and Volkswagen.

Hyundai announced that it plans to deploy its battery cell-to-vehicle or CTV structure in its future EV lineup. According to the company, the CTV structure, which integrates the battery and the vehicle body, can improve battery integration and performance, reduce parts to lighten the weight by 10% compared to the previous CTP (cell-to-pack) system.

Moreover, by 2030, the Korean carmaker aims to develop its own affordable NCM (nickel-cobalt-manganese) batteries to offer a wider portfolio of batteries. The planned affordable NCM battery will complement the carmaker’s currently used performance-oriented NCM batteries as well as the low-cost LFP (lithium-iron-phosphate) batteries.

“This new entry-level battery will first be implemented in volume models, with the company anticipating a battery performance enhancement of over 20% by 2030, through ongoing improvements in battery energy density,” Hyundai said.

Hyundai further said that it has developed a battery system safety structure that prevents heat transfer between battery cells, regardless of the battery form factor. It is also developing an advanced cooling technology that suppresses the occurrence of flames inside the battery and aims to apply it to mass-produced vehicles by 2026.

“Under the Hyundai Way, we will respond to the market with agility, thanks to Hyundai’s unique flexible response system. This will secure sustainable leadership in an uncertain market environment and strategically position the company to create a future centered on mobility and energy. Hyundai will strengthen its position as a game changer by expanding beyond vehicle manufacturing to various forms of mobility. By enhancing the role of energy business operators and realizing a hydrogen society, we intend to transform into a company that can maintain global top-tier leadership in the era of energy transition,” said Jaehoon Chang, President and CEO of Hyundai Motor Company.

Adding further, he said, “In the electrification era, Hyundai has distinguished itself by rapidly launching a comprehensive lineup of EVs, catering not only to mass-market brands but also to the luxury and high-performance segments. Building on our advanced technology and dedication to innovation, we aim to secure a leading position in the market as the adoption of electrified vehicles gains momentum.”

Hyundai: 2024 CEO Investor Day summary

a) Hyundai Dynamic Capabilities:

- Achieved global sales volume of 4.21 million units in 2023, making Hyundai one of the top 3 automakers globally.

- Announced expansion of its hybrid line up from 7 to 14 models (across all brands including Genesis), moving hybrid tech into large and luxury models.

- Hyundai to launch next-generation TMED-II system, which is slated for integration into production vehicles from January 2025.

- All future hybrid vehicles to be equipped with premium tech; eg: regenerative braking, V2L etc

- Hyundai expects surge in hybrid demand in North America, sets hybrid sales target of 690,000 units by 2030.

- To manufacture hybrid cars at Metaplant America in Georgia, US, alongside BEV models such as Ioniq 5 and Ioniq 9 three-row SUV – move to enhance operational efficiency of the factory.

- Hyundai acknowledges North American market is currently facing a shortage of hybrid supply.

- Hyundai targets to sell 1.33 million hybrid vehicles a year globally by 2028, achieving 40% YoY growth in global sale of hybrid vehicles.

- Also developing an EREV; carmaker announces the development of a new powertrain and power electronics system (PT/PE) to enable four-wheel drive with two motors.

- Hyundai said intent behind developing EREVs is to bridge the portfolio gap while offering consumers an EV-like driving experience, allowing for natural transition to pure EVs. EREVs to be cheaper than BEVs, thanks to smaller battery.

- To mass produce EREVs in North America and China by end 2026, with sales commencing in early 2027. In North America, Hyundai plans to launch D-class SUVs with EREV tech (under Hyundai and Genesis) to cater to the remaining demand for ICE vehicles; sales target ~80,000+ units.

- For China, Hyundai plans EREV models on C-segment platform [due to intense competition], sales target ~30,000+ units.

- Hyundai plans full EV line up, from affordable to luxury, with 21 models by 2030.

- By 2030, Hyundai plans to add 1 million units of production capacity to sell 5.5 million vehicles globally.

- Under this plan, Hyundai aims to sell 2 million EVs by 2030 globally.

- Of the capacity addition for 1 million units by 2030 – 500,000 units of additional capacity will come from Metaplant America (beginning ahead of schedule in 2024) and Ulsan, South Korea (beginning in 2026).

- Acquired GM’s Pune (India) factory to build capacity for 1 million units in India.

- Aims to maximize factory utilization in China, Indonesia, while expanding CKD business in Middle East, Asia-Pacific and other regions.

- Hyundai plans to have an edge on battery tech with its Uiwang Research Institute, slated to open later in 2024. Carmaker looks to expedite development of next-gen battery tech, including solid-state batteries. Also plans to apply cell-to-vehicle (CTV) structure optimized to improve battery integration, reduce parts and save weight by 10% compared to cell-to-pack (CTP) system.

- By 2030, Hyundai plans to deploy affordable NCM batteries to widen its product range, in addition to using high-performance NCM and low-cost LFP battery tech. The entry-level NCM battery to go into mass market cars with company aiming to achieve 20% performance enhancement via improved density by 2030.

- Hyundai announced that it has developed a battery system safety structure that prevents heat transfer between battery cells, regardless of the form factor. Company is also developing an advanced cooling tech that suppresses occurrence of flames inside the battery. Tech to go into mass produced cars in 2026.

b) Mobility Game Changer:

- Hyundai is developing a zonal E/E architecture optimized for SDVs

- Focus on developing its digital cockpit, featuring next-gen UI-UX designs

- Hyundai plans to apply next-gen infotainment system based on android (AAOS) from H1 2026.

- To roll out SDV pace car built on zonal E/E architecture in H2 2026, followed with Hyundai’s expansion of full stack software tech on other models.

- To launch autonomous vehicle foundry business.

c) Energy Mobilizer:

- Expand fuel cell system lineup to wider applications – trains, advanced air mobility, heavy equipment, sea vessels.

Investment and financial targets:

- Hyundai plans to invest KRW120.5 trillion between 2024-2033 [~KRW11.1 trillion more than last year’s announcement]. Split of investments: KRW54.5 trillion in R&D, KRW51.6 trillion in CAPEX and KRW14.4 trillion for strategic investments.

- Hyundai is targeting operating profit margin of 9-10% in 2027 and over 10% in 2030. Expects equal profitability on its entire powertrain lineup, including ICEs, hybrids, EREVs and EVs by 2030.