The survey results indicate that R&D spending is critical for medium- and long-term goals for companies within the industry, particularly to develop their market positioning. However, some companies are still cautious about planning a high-spending year until the market conditions for products have settled to a predictable level.

The key findings of the ‘2021 IHS Markit global automotive R&D survey’ are:

- 6.5% average increase in automotive R&D spending by companies.

- Greater China leading the spending recovery while Europe still in negative spending territory.

- Silicon vendors are planning to spend higher budget (5.27%) while technology companies are cautious on spending (0.48%).

- 45% companies will spend more on developing software features.

- E-Mobility domain (23%) will see a higher R&D investment in coming years compared to other domains.

- 36% of the companies will spend their R&D budget to hire software laborers while 21% companies will spend to hire test and integration laborers.

The survey reached a broad range of respondents across the automotive industry, receiving good levels of response from automakers (OEMs), tier-1 suppliers, silicon vendors, and independent technology and software firms. Responses were also captured globally, including those working for North and South American, European, Chinese, Japanese, and Korean organizations. This insight presents the results of the survey and an analysis of the implications.

Research methodology

The ‘2021 Global Automotive R&D Survey’ ran through the entire course of March 2021. Participants were invited to via direct mailings to existing contacts of Supply Chain & Technology – IHS Markit. All respondents were invited to offer their personal opinions to the questions posed.

- 94 companies have taken part in the survey, covering access of USD110 billion as of February 2020 (according to survey data).

- 32% of the respondents worked at an OEM, while 35% respondents were from tier-one and two suppliers.

- 33% of the respondents were from silicon vendors, technology companies, special and test support firms, and connected-car supporting telecom companies.

- 68% of the respondents worked in a sales and marketing functions, while 22% of respondents worked in advanced engineering and product development functions.

- 28% of the respondents were based in Europe, 26% in North America, 20% in Greater China, 16% in Japan and Korea, and 10% were based in India.

R&D spending growth trajectory

The survey data shows an overall positive growth of 6.5% in global automotive R&D spending by companies compared to 2020.

However, Europe did not fare well among regional analysis, with a negative trend in R&D spending by companies based on the continent this year. This is offset by a modest growth seen with Chinese companies.

Among stakeholders, OEMs, tier-1 suppliers, and silicon vendors all showed a positive trend toward R&D spending, particularly the latter across short, medium, and long terms.

Contrastingly, (large, medium, and small-sized) technology companies are being cautious with their budget spending. This may be due to a wait-and-see policy for a predictable market scenario in the short to mid-term.

Results also depict a negative scenario for automotive test and special companies that provide support to both OEM and tier-1 product designs, validation, certifications, and other consumable activities, as well as connected car supportive telecom service providers. According to the latter, a reason for this year’s slow R&D uptakes may be due to some uncertainty in regional regulations and business cases related to 5G support for the consumer electronics environment.

During the period of this survey, automotive industries witnessed a disruption within the supply chain of semiconductors. This shortage issue is still ongoing, and an unavoidable concern should be raised on whether the semiconductor shortage issue will influence R&D spending strategies. However, the results illustrate that this issue will not influence automotive companies’ attitude toward this budget in the coming years as this issue is viewed as a short-term problem that will be resolved within a year.

Areas of R&D spending

The results show 45% of companies will spend their R&D budget on software and software-related feature development, followed by 26% in vehicle electrical architecture development; a similar trend as per the 2020 global automotive R&D study by IHS Markit.

However, this year’s study shows some investment scenarios in hardware unlike in 2020, especially from OEMs. This is due to the higher number of battery-operated electric propulsion technology developments and system integration around e-mobility features.

Overall, the results highlight that the focus is shifting in the automotive industry, both from OEM and supplier perspectives: stakeholders are placing software development right at the forefront due to its decisive role in the vehicle of the future.

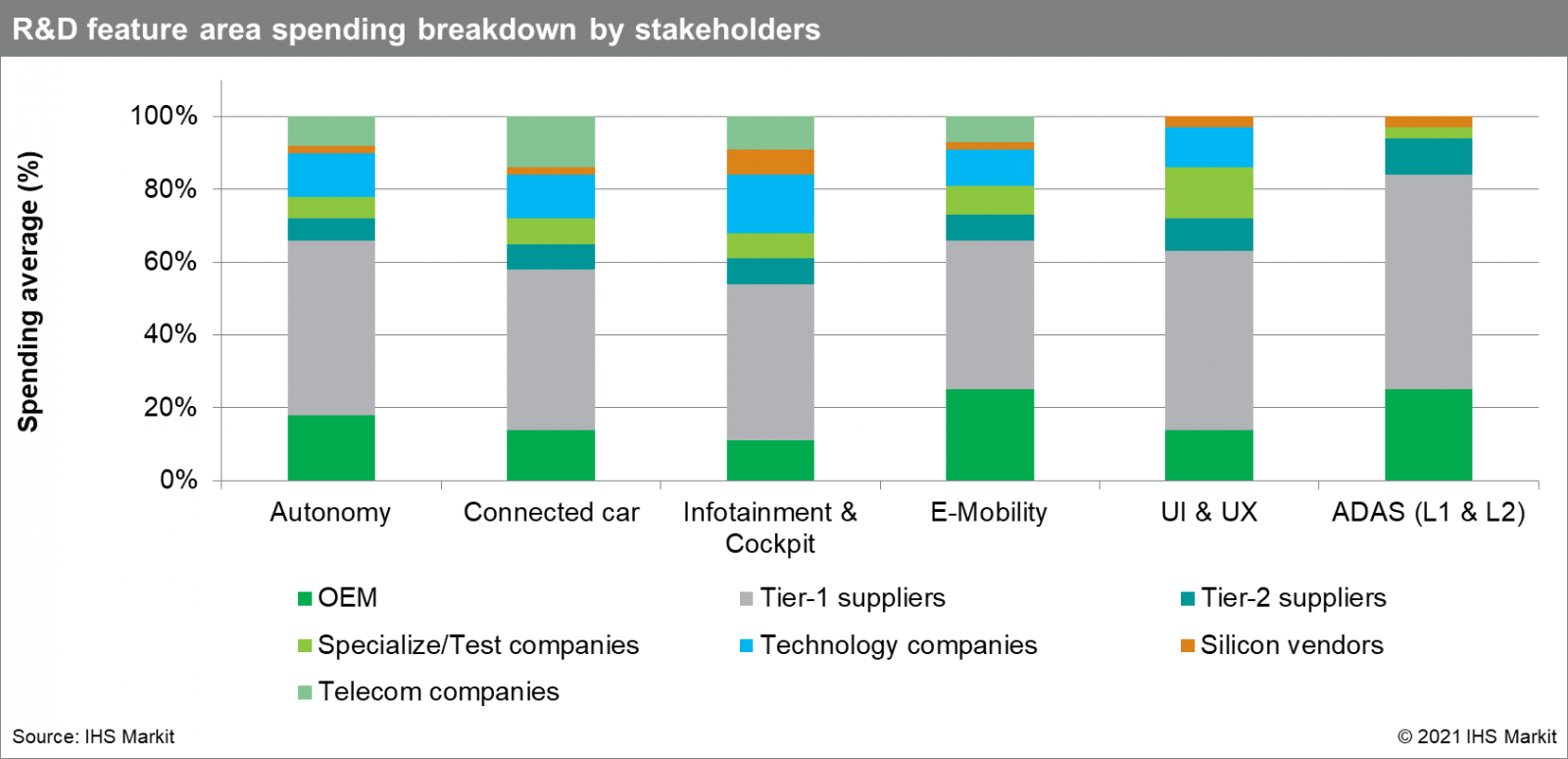

R&D feature spending

E-mobility has emerged as the main feature of investment according to the 2021 R&D survey results, namely around battery technology and management systems, e-motors, and power electronics. This is a sharp contrast to the 2020 survey results, where e-mobility features were highlighted as one of the main negatively impacted areas. This is no surprise as many OEMs worldwide have now declared for full ranges of electric vehicle (EV) suites in their product portfolios as early as 2025.

Climate change has also become a focal point on a global level in politics, business, and society. Vehicle manufacturers are seeing regulatory challenges that are influencing business and pushing electrification. For example, the European Green Deal (by the European Commission) accelerates decarbonization policies and will result in the adoption of a carbon dioxide (CO2) reduction target increased from 40% to 55% for all European Union fleets by 2030.

For OEMs, the car of the future is fully electric; battery electric vehicles (BEVs) are vital in fighting climate change., As such, e-mobility is a major window of opportunity for R&D investment and will drive growth over the next 20–30 years.

While OEMs will focus more on E-mobility in the short-to-medium term, suppliers will spend more in the area of autonomy and connected cars.

Results also show silicon vendors and technology companies have specific requirements around software investment. Software features such as hypervisors, multi-operating infotainment systems, and standardized middleware interface developments will be focus areas for these companies.

Both suppliers and OEMs will continue to invest in ADAS (Level 1 and Level 2)-specific vehicle safety functions, in order to improve quality and to reduce costs around these features.

Future R&D planning by companies

While the majority of automotive companies are gearing up their R&D budget toward both short- and long-term software development work, this year’s study revealed an interesting pattern; OEMs are defining their R&D strategy toward the development of features/requirements to comply with upcoming regulations (in terms of e-mobility, connectivity, and autonomy). All car companies have an ambitious plan to deliver BEVs that have to comply with all upcoming regulations from Europe, Greater China, North America, and other regions.

Meanwhile, tier-1 suppliers will invest more to improve product quality and reduce recalls (warranty returns).

Some OEM and tier-1 supplier respondents argued that automotive companies may well boost spending on improving internal combustion engine (ICE) technologies to mitigate negative public perceptions, improve efficiencies, and cope with new and upcoming regulations.

Furthermore, some participants highlighted a cautious approach to R&D spending moving forward and potential challenges around new market patterns that will emerge in the near future due to changing consumer purchasing patterns. This includes increased remote working that negatively impacts the necessity of vehicle ownership.

Recovery regions

There is an overwhelming agreement that R&D growth and recovery will be led by Greater China and companies from that region. Although results show a negative R&D spending growth from Europe this year, participants show more confidence in medium-term recovery and growth than that of North American respondents.

Operational and capital spending planning

Results illustrate that 36% of companies intend to spend their R&D budget toward hiring software laborers, while 21% of companies will spend their budget on hiring test and integration laborers. This is unsurprising as most of the companies are ramping up their efforts to develop new software features and integrating software in the wider ecosystem, as shown in previous section’s survey results.

OEMs will invest a greater number of financial resources to hire project-specific resources (40%), while tier-1 suppliers will spend more of their budget to hire software laborers (40%).

Conclusion

Based on the survey data at hand and further market analysis, IHS Markit forecasts that the global R&D spend profile by automotive companies will show a positive trend in 2021 with a healthy growth from 2022.

Greater China and Chinese automotive companies will lead the R&D investment, both in the short and medium term, while e-mobility and autonomy will be a key focus for short- and mid-term R&D.

All stakeholders will also shore up their operational and capital investment in the area of software resources, which will act as a benchmark of medium-term product differentiations and growth strategies.

Dr. Tawhid Khan, Research Director, IHS Markit

Email address: tawhid.khan@ihsmarkit.com