Global BEVs to reach 171 million by 2032. Recycling race, opportunities and costs explored by S&P Global Mobility in new study.

Sustainability vs. economics

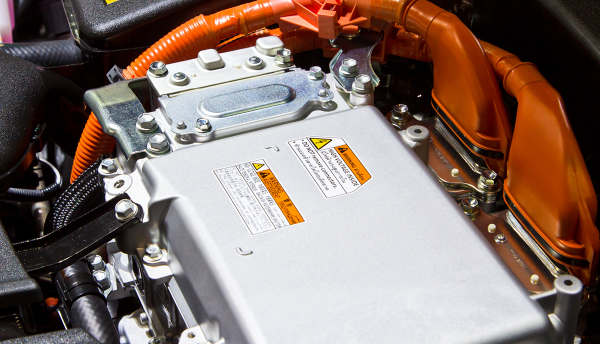

Battery-electric vehicles (BEVs) in operation will reach 171 million units globally in 2032, according to S&P Global Mobility. What will happen to all those end-of-life batteries? The race is on to recycled electric vehicle (EV) batteries. But at what cost and who stands to gain?

EV sales are blossoming but it is still a waiting game for battery recyclers. Where and when is the window of opportunity for high-voltage battery recycling? A new study by S&P Global Mobility on the battery recycling supply chain, policy and regulations and market sizing addresses these issues.

Policy support

While the EU passed regulations in July 2023 mandating EV battery recycling, the US does not (yet) have similar legislation in place, opting instead for recycling through incentives, as outlined in its Inflation Reduction Act. The absence of guidelines may hinder the repurposing of viable batteries before recycling, undermining sustainability efforts. Recycling requires less energy and generates less pollution compared with mining, but the sheer economics of recycling may not always be favorable without policy support.

Recycling car battery packs at the end of their useful life is not currently cost-effective or straightforward. However, those costs will tumble as the number of EVs on the road increases, enabling economies of scale. Some original equipment manufacturers, including Tesla, are ahead of the game by recycling up to 92% of battery materials to eliminate the need for mining new resources.

Recycling offers the potential to reuse a metal atom an infinite number of times, but the cost-efficient retrieval of materials is what matters to recyclers. The Democratic Republic of Congo is the main producer of cobalt, a costly component in lithium-ion batteries. However, manufacturers are working to remove cobalt from their battery chemistries and distance themselves from politically unstable countries in the process. This poses challenges to the recycling value proposition. Even without cobalt, batteries still contain valuable materials like lithium and nickel. Yet again, the economic feasibility of recycling materials, such as lithium, manganese and nickel, may be limited or require additional processing, which ramps up costs.

Closing the loop

Given the long lifespan of EV batteries, many batteries will have a second life as renewable energy storage long before being recycled. The future availability of batteries for recycling depends on various factors, particularly production scrap. Scrap generated during the manufacturing process of BEV batteries includes rejected or defective batteries and excess materials or components that do not meet quality standards. It consists of metals, electrolytes and other components. Scrap from cell production accounts for a large part of the total production scrap followed by battery pack production scrap and battery module production scrap.

Implications

Greater China currently holds the largest share of the global market for end-of-life new-energy vehicles (NEVs) due to its large fleet size and early adoption of NEVs. The study further predicts an increase in total production scrap in Greater China from 47.64 GWh in 2023 to 119.21 GWh in 2032, with end-of-life batteries expected to rise from 20.85 GWh in 2023 to 617.31 GWh in 2032. However, the total available waste batteries will likely increase from 68.49 GWh in 2023 to 732.92 GWh in 2032.

It is a different situation for raw materials. For lithium, we see a six-fold increase in demand between 2022 and 2030 from some 0.06 million metric tons to 0.37 million for light passenger vehicle applications alone. Consequently, lithium markets will likely be in deficit by 2027, creating a bottleneck for automotive supply. The resolution will be slow as lithium takes an average of 15.7 years to reach the market after discovery. Hence the recent focus on battery recycling.

We also expect some of the gap to mainland China to be clawed back as the market expands and the diversity of battery chemistries continues. Cobalt, for example, mined in the Democratic Republic of Congo (DRC) yet processed in mainland China, will be increasingly sourced and processed elsewhere toward the end of the decade to decrease reliance on the DRC and exposure to Environmental, Social and Governmental (ESG) risk.

A robust circular battery economy could reduce or eliminate the need for mineral extraction but that’s still a long way off.

S&P Global Mobility’s Component Forecast Analytics provides timely, reliable and comprehensive automotive component and technology data and powerful analytics from one of the most trusted sources in the industry. To learn more about our Battery forecasts, visit

https://autotechinsight.ihsmarkit.com/services/46971/battery

Copyright © 2025 S&P Global Inc. All rights reserved.

These materials, including any software, data, processing technology, index data, ratings, credit-related analysis, research, model, software or other application or output described herein, or any part thereof (collectively the “Property”) constitute the proprietary and confidential information of S&P Global Inc its affiliates (each and together “S&P Global”) and/or its third party provider licensors. S&P Global on behalf of itself and its third-party licensors reserves all rights in and to the Property. These materials have been prepared solely for information purposes based upon information generally available to the public and from sources believed to be reliable.

Any copying, reproduction, reverse-engineering, modification, distribution, transmission or disclosure of the Property, in any form or by any means, is strictly prohibited without the prior written consent of S&P Global. The Property shall not be used for any unauthorized or unlawful purposes. S&P Global’s opinions, statements, estimates, projections, quotes and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security, and there is no obligation on S&P Global to update the foregoing or any other element of the Property. S&P Global may provide index data. Direct investment in an index is not possible. Exposure to an asset class represented by an index is available through investable instruments based on that index. The Property and its composition and content are subject to change without notice.

THE PROPERTY IS PROVIDED ON AN “AS IS” BASIS. NEITHER S&P GLOBAL NOR ANY THIRD PARTY PROVIDERS (TOGETHER, “S&P GLOBAL PARTIES”) MAKE ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE PROPERTY’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE PROPERTY WILL OPERATE IN ANY SOFTWARE OR HARDWARE CONFIGURATION, NOR ANY WARRANTIES, EXPRESS OR IMPLIED, AS TO ITS ACCURACY, AVAILABILITY, COMPLETENESS OR TIMELINESS, OR TO THE RESULTS TO BE OBTAINED FROM THE USE OF THE PROPERTY. S&P GLOBAL PARTIES SHALL NOT IN ANY WAY BE LIABLE TO ANY RECIPIENT FOR ANY INACCURACIES, ERRORS OR OMISSIONS REGARDLESS OF THE CAUSE. Without limiting the foregoing, S&P Global Parties shall have no liability whatsoever to any recipient, whether in contract, in tort (including negligence), under warranty, under statute or otherwise, in respect of any loss or damage suffered by any recipient as a result of or in connection with the Property, or any course of action determined, by it or any third party, whether or not based on or relating to the Property. In no event shall S&P Global be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees or losses (including without limitation lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Property even if advised of the possibility of such damages. The Property should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions.

The S&P Global logo is a registered trademark of S&P Global, and the trademarks of S&P Global used within this document or materials are protected by international laws. Any other names may be trademarks of their respective owners.

The inclusion of a link to an external website by S&P Global should not be understood to be an endorsement of that website or the website's owners (or their products/services). S&P Global is not responsible for either the content or output of external websites. S&P Global keeps certain activities of its divisions separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain divisions of S&P Global may have information that is not available to other S&P Global divisions. S&P Global has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P Global may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P Global reserves the right to disseminate its opinions and analyses. S&P Global Ratings’ public ratings and analyses are made available on its sites, www.spglobal.com/ratings (free of charge) and www.capitaliq.com (subscription), and may be distributed through other means, including via S&P Global publications and third party redistributors.