Aluminum is shedding pounds and emissions — An interview with Hydro

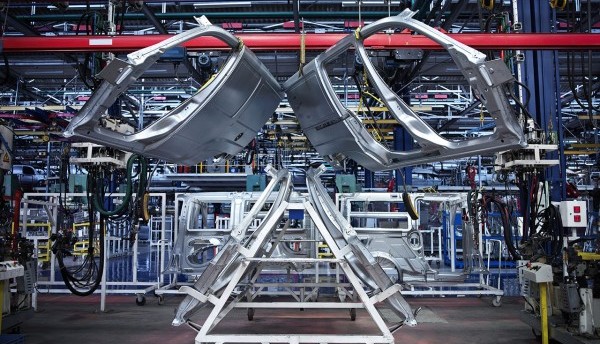

As regulatory pressures to reduce emissions intensify, manufacturers are increasingly turning to aluminum to boost fuel efficiency. Vehicles made from aluminum can weigh up to 50 percent less than their steel counterparts, leading to significant reductions in fuel consumption and greenhouse gas emissions.

This lightweighting trend aligns with global regulatory frameworks designed to lower carbon footprints, including the European Union's strict CO2 emissions targets and the US Corporate Average Fuel Economy standards. These regulations are prompting automakers to innovate with materials such as aluminum, enhancing performance while ensuring compliance.

Aluminum's recyclability further contributes to sustainability; about 75 percent of aluminum produced is still in use today, with a recycling rate exceeding 90 percent in the automotive sector. This closed-loop recycling process significantly reduces energy consumption compared to primary aluminum production, which is highly energy-intensive.

However, challenges persist. Initial costs for aluminum components can be higher than traditional materials, and supply chain issues related to sourcing and recycling need to be addressed. Additionally, regulatory bodies are scrutinizing the environmental impacts of aluminum mining and processing, urging more responsible practices.

Aluminum’s role in vehicle manufacturing is crucial, enhancing lightweighting and sustainability while navigating complex regulatory landscapes. As the industry evolves, the focus on aluminum will likely deepen, reflecting a commitment to eco-friendly practices and innovation in automotive design. Notably, major players like Hydro are spearheading the development of sustainable aluminum solutions, offering low-carbon and recycled products that meet rising regulatory demands. To gain further insights, we spoke with aluminum material experts at Hydro.

Key takeaways:

- The substantial rise in China's aluminum production to nearly 60 percent of global output has led to significant market overcapacity. This situation is exerting downward pressure on aluminum prices and availability, potentially prompting European automakers to reassess their aluminum sourcing strategies in light of increased competition from Chinese electric vehicles.

- The European Union's investigation into potential anti-subsidy practices related to Chinese EVs underscores the escalating regulatory landscape. This scrutiny could result in tariff adjustments or trade barriers that may disrupt established supply chains and influence aluminum procurement strategies within the European market.

- The automotive sector's transition toward sustainability is increasingly reliant on aluminum's high recyclability, with over 90 percent of aluminum from end-of-life vehicles being repurposed. This characteristic is integral to achieving lifecycle emissions reductions and supporting a circular economy, necessitating advanced recycling technologies to optimize material recovery.

- The energy input for aluminum production is a critical determinant of carbon footprint, with traditional coal-based processes exhibiting CO2 emissions up to five times higher than those using renewable energy. The industry's shift toward renewable energy sources is essential for aligning with stringent emissions reduction targets and enhancing overall sustainability.

- The automotive industry's focus on lightweighting necessitates the development of advanced aluminum alloys that optimize strength-to-weight ratios. Collaboration across the supply chain is essential to innovate materials that not only meet rigorous safety and performance standards but also facilitate compliance with emerging environmental regulations.

The following is an edited transcript of the conversation.

S&P Global Mobility: How do you foresee the influx of Chinese EVs impacting aluminum demand among European automakers, and what strategies is Hydro implementing to address this challenge?

Over the past 20 years, aluminum production in China has grown from around 10 percent of the global production to nearly 60 percent, leading to a surplus of aluminum in the global market. In addition, for many years, China has considered the aluminum industry as a strategic sector to develop. This has resulted in massive industry support, mainly via subsidies, resulting in overcapacity.

While at first the overcapacity affected the production of primary aluminum, it has since spilled over to semi-finished products such as aluminum extrusions and to recycling capacities, and then to finished products such as solar panels and EVs.

The increasing numbers of imported electric cars from China could have a big impact on regional demand if European automakers start reducing their demand for aluminum because of competition from Chinese EVs.

Hydro competes in a global market every day. We work to make sure that the competition is fair, and that we have a level playing field. We also invest in research and development to develop new aluminum products and technologies, we have formed strategic partnerships with key players in the automotive industry, such as Mercedes, Porsche and Volvo Trucks, and we make sure that we have a diverse portfolio, targeting sectors like renewable energy, construction and packaging. In addition, we are continuously working to improve operational efficiency and reduce costs to remain competitive in the global market.

What implications does the EU's anti-subsidy probe on Chinese EVs have for the European aluminum market and Hydro's operations?

Hydro supports free and fair trade in all products, also in EVs. [The] EU Commission has opened for dialogue with China to find solutions on the unfair trade practices found in Chinese EV production. For European industry to stay competitive, the strength of our trade defense, as well as having a level playing field on energy cost, social standards and [a] healthy investment climate in general, are crucial.

How does the use of aluminum in EVs, particularly in battery pack casings, affect the competitive landscape for European manufacturers?

Aluminum is becoming increasingly important as a lightweight material in EVs, as it can reduce emissions and weight without compromising safety. A study by Hydro that investigates the environmental impact of a car throughout the entire life cycle shows that lightweighting (using aluminum for a car’s structure can lessen weight by 30 percent compared to steel). Use of low-carbon aluminum can make the automotive industry greener. The complete recyclability of aluminum also means that single-use materials can be avoided, and today more than 90 percent of aluminum contained in a scrapped car is recycled.

This means low-carbon aluminum has an important role in producing true zero-emission cars. This is one of the biggest advantages of European manufacturers: To pave the way for zero-emissions production. Like-minded actors along the entire value chain need to work together on material selection, recycling, transparency and traceability. However, sustainability is not only about climate, but includes people and nature too. Automotive makers and suppliers must also work together to ensure the materials are sourced in a responsible way for people and planet.

It's important to remember that it matters where and how aluminum is produced. While the global average of aluminum is around 15.1 kg CO2 per kilo aluminum, this can go down to almost zero if we produce aluminum components entirely based on post-consumer scrap aluminum as the raw material for the new component (like Hydro does with Hydro CIRCAL 100R). The source of energy used to produce and remelt aluminum also has a big impact. An aluminum smelter that bases its electricity on coal, as is common in several regions of the world, has five times higher CO2 emissions than one that bases it on electricity from renewable sources.

Given the challenges posed by energy prices and competition, what innovations is Hydro pursuing to maintain its position in the European aluminum market?

Hydro is Europe’s largest producer of aluminum for the European market, providing about 40 percent of all aluminum used in Europe. The power consumption at Hydro’s Norwegian smelters is based entirely on renewable energy (mainly hydropower). Hydro is close to fully covered through 2030 with long-term power purchase agreements, based on an average annual equity hydropower production of 9.4 TWh and a long-term contract portfolio of around 10 TWh per year. In times with increasing power prices, like Europe experienced after the Russian invasion of Ukraine that in turn has led to a reduction in aluminum production capacity of 50 percent, this has been a competitive advantage for Hydro and our Norwegian smelter portfolio.

While Hydro's alumina refinery in Brazil is transitioning to more sustainable fuel sources to mitigate emissions in upstream operations, our primary aluminum production in Norway is powered by 100 percent renewable energy. Globally, Hydro’s renewable energy share is at over 70 percent. Through our business area Hydro Energy and our [joint venture] Hydro Rein, we are working to increase the use of renewable energy even further. Hydro Rein supports Hydro and other industrial companies to decarbonize through large renewables projects and energy efficiency or onsite power generation. The solar and wind projects of Hydro Rein in Brazil are some of the largest renewable energy sites on the continent and are important enablers to decarbonize our refinery operations and reach Hydro’s target of a 30 percent CO2 reduction by 2030.

In addition, we continue to invest in recycling capabilities and technology, including adding recycled content to primary aluminum to reduce the CO2 footprint even more at our Norwegian smelters. We believe the importance of recycling post-consumer aluminum will continue to increase in the years and decades to come. The fastest way to deliver zero-carbon aluminum is by recycling post-consumer scrap, which is aluminum that has lived a past life as beverage cans, windows or car parts. We have delivered the first volumes of 100 percent recycled aluminum to our customers, pushing the boundaries for recycled aluminum with a carbon footprint below 0.5 kilo CO2e per kilo aluminum, which is 97 percent lower than the global average for primary aluminum.

Hydro’s technologists are also engaged in the development of a breakthrough technology for primary aluminum production. If successful, the technology called HalZero could potentially revolutionize the aluminum industry, using a method where oxygen is emitted instead of carbon dioxide leading to a CO2 emission free smelting process.

How does recycled aluminum contribute to reducing the carbon footprint of EVs, particularly regarding weight reduction and battery efficiency?

Use of aluminum is a big benefit for weight reduction and battery efficiency in EVs. The lighter the car is, the longer the battery will be able to go on a single charge. Recycled aluminum is a very valuable resource in the production of EVs, offering significant benefits in terms of lower CO2 footprint and overall environmental sustainability. By incorporating recycled aluminum into EV components, automotive manufacturers can contribute to a greener and more sustainable transportation future.

What low-carbon production technologies does Hydro employ to minimize CO2 emissions during the aluminum manufacturing process?

Hydro has been actively pursuing innovations to maintain its position in the European aluminum market and deliver low-carbon aluminum to demanding customers in Europe, working actively to also reduce the CO2 footprint of our customers.

The fastest way to deliver zero-carbon aluminum is by recycling post-consumer scrap, which is aluminum that has lived a past life as beverage cans, windows, car parts, etc. We have delivered the first volumes of 100 percent recycled aluminum to our customers, pushing the boundaries for recycled aluminum with a carbon footprint below 0.5 kilo CO2e per kilo aluminum, which is 97 percent lower than the global average for primary aluminum.

We have invested heavily in recycling capacity over the last decade, and we will continue to do so also toward 2030. Today, Hydro’s recycling operations consist of 27 recyclers and a sorting facility in Europe, United States and Canada for our aluminum metal and extrusions business areas. The total capacity is approximately around 2 million metric tons per year.

Hydro has also started using post-consumer scrap together with primary aluminum to reduce the footprint of primary metal even further. By combining hydropower as an energy source, modern production technology and recycling of scrap, Hydro can deliver aluminum with a carbon footprint of less than 3 kg CO2 per kg aluminum. This is around 80 percent lower than the global average.

We see an increasing pull from the market to deliver low-carbon aluminum, exemplified with our partnership with Mercedes-Benz, where Hydro will supply low-carbon aluminum to reduce the carbon footprint of their vehicle fleet, including a common low-carbon technology roadmap in the period 2023-2030.

Can you elaborate on the advanced manufacturing techniques and specific aluminum alloys that Hydro recommends for lightweighting in automotive applications?

The alloys used for lightweighting will depend on the part in question, and whether it is based on casting, extrusion, forging or sheet materials. There are a wide range of possible alloys that are optimized to give certain properties. A development trend is to compose alloys to make them more suitable for allowing significant recycled content.

How does Hydro ensure traceability and transparency in its supply chain for low-carbon aluminum products, and why is this important for automotive manufacturers?

Hydro is committed to ensuring traceability and transparency throughout its supply chain for low-carbon aluminum products. Hydro has a unique position with presence in the entire aluminum value chain, from mine to finished component. Hydro utilizes this integrated value chain to deliver low-carbon aluminum products, complete with traceability and transparency at every step. In addition, we rely on certifications, such as the Aluminum Stewardship Initiative and third-party audits and verifications of our products and processes from DNV.

Over the last years we have seen a strong increased focus on sustainability in the automotive industry, expanding beyond tailpipe CO2 emissions with a more holistic approach that also includes a focus on social and economic development, and environment and biodiversity conservation. Traceability and transparency in Hydro’s supply chain for low-carbon aluminum products is essential for building trust with our automotive customers, complying with regulations, and contributing to a more sustainable future for the automotive industry.

What strategies does Hydro have in place to collaborate with original equipment manufacturers on optimizing product design for weight reduction and compliance with safety standards?

Hydro’s strategy is to create value for all customers by being involved early in the development phase to influence the design of the products. One natural topic in such discussions is weight reduction as the amount of aluminum in a product defines a big share of the cost for a product.

Hydro is working individually with the OEMs to optimize the design and performance of the products, both for weight reduction and safety performance. One important component of safety performance is alloy development and Hydro offers specifically developed aluminum alloys that are optimized for safety performance.

What challenges do manufacturers face when transitioning from traditional materials to aluminum for lightweighting, and how can Hydro assist in overcoming these challenges?

Hydro has a unique ability to utilize the integrated value chain to deliver low carbon aluminum products, and Hydro has delivered aluminum components and applications for automotive, with the aim to lightweight, for a very long time.

We have established joint roadmaps with several customers in the automotive industry to take the CO2 footprint of the aluminum further down towards zero. One of the paths we follow is the increased amount of recycled content in the alloys. Hydro has, together with companies such as Porsche and Mercedes, technical collaborations and technology development to develop new and improved alloys with higher recycled content that at the same time, fulfill the automotive industry’s high requirement for metal quality and verifications.