The partnership introduces Nvidia's cuLitho platform to TSMC's processes, enhancing efficiency and overcoming traditional computational bottlenecks

As reported in a press release on Oct. 8, TSMC has partnered with Nvidia to implement Nvidia's cuLitho computational lithography platform into its production processes. The collaboration aims to enhance the manufacturing pace and overcome the physical limitations encountered in the creation of advanced semiconductor chips.

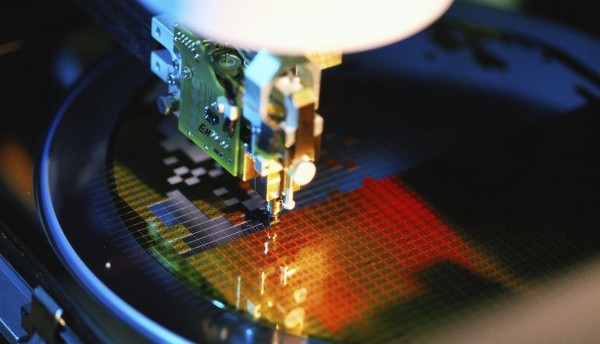

Computational lithography, a vital phase in chip production, involves transferring circuit designs onto silicon through a process that integrates various complex computational fields. Traditionally, this stage has been a significant bottleneck in the semiconductor industry due to its intensive computational demands, which require substantial data center resources.

Nvidia's cuLitho platform introduces accelerated computing to computational lithography, significantly improving efficiency. For instance, a computational task that would typically occupy 40,000 CPU systems can now be handled by just 350 Nvidia H100 Tensor Core graphics processing unit (GPU)-based systems. This advancement not only accelerates production times but also cuts down on costs, space and energy consumption. C.C. Wei, CEO of TSMC, highlighted the substantial performance improvements, throughput enhancements, cycle time reductions, and lower power requirements achieved through the integration of GPU-accelerated computing into its workflows.

Moreover, Nvidia has further boosted the capabilities of the cuLitho platform by incorporating generative AI algorithms, which have been shown to double the speedup of the accelerated processes. This AI-driven approach facilitates the generation of a near-perfect inverse mask, crucial for compensating light diffraction in computational lithography, thereby doubling the efficiency of the optical proximity correction process. This enhancement marks a significant advancement in semiconductor lithography, a field that has historically seen gradual improvements over its three decades of existence.

The company said that the combination of accelerated computing and AI technologies has the potential to revolutionize the semiconductor manufacturing industry by enabling more precise simulations of physics and the application of mathematical techniques previously deemed too resource-intensive. The cuLitho platform, with its ability to significantly expedite the computational lithography process, not only shortens the time required to develop new technology nodes but also facilitates new computational approaches, such as inverse and curvilinear solutions, that are crucial for the production of next-generation semiconductors. This technological leap promises to elevate the capabilities of leading-edge foundries in creating powerful and advanced semiconductor devices.