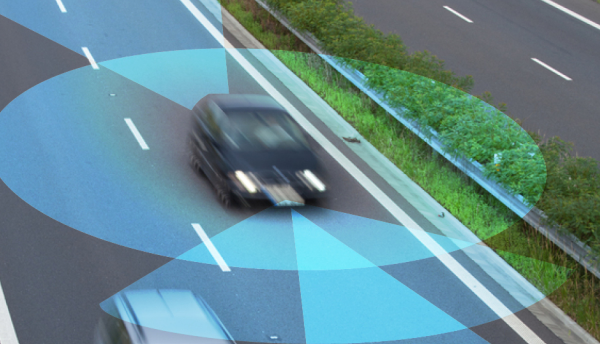

How 4D imaging radar enhances autonomous driving with real-time, accurate environmental insights

Four-dimensional (4D) imaging radar is a key technology for autonomous driving, providing real-time and accurate information about the surrounding environment. To learn more, we spoke to executives from Aptiv.

Four-dimensional imaging radar is an emerging key technology for autonomous driving, providing real time and accurate insights into the surrounding environment. It complements other sensors such as cameras and is used in conjunction with these in the automotive industry. The 4D imaging radar uses multiple antenna arrays to gather extensive data and generate precise 3D models. It operates at frequencies such as 77 or 79 GHz, enabling split-second reaction times that are required for autonomous vehicles. The future of imaging radar involves improving sensor fusion algorithms and developing wider aperture radar systems to achieve higher levels of autonomy in autonomous vehicles.

The following is an edited transcript of the conversation.

S&P Global Mobility: Can you describe the significance of 4D or imaging radar in the evolution of radar technology? In what ways does imaging radar improve automated driving or enable higher levels of automation, such as in navigating tricky situations, managing false-positives, or filling a performance gap in other common sensors like camera, traditional radar or lidar?

Aptiv executives: 4D radar has significant advantages over 3D radar, particularly when it comes to identifying the height of an object, i.e., how far a vehicle is from an overpass/seeing vertically. 4D radar is also superior to 3D radar in identifying objects in the roadway at long distances and helping the vehicle decide the appropriate action to take.

Radar can reliably indicate how far away an object is. Typical long-range automotive radars can provide range measurements on objects that are as much as 300 meters to 500 meters away; 4D radar can measure even farther. Cameras, by contrast, must try to estimate how far away an object is based on its size in the camera’s image and other factors.

4D radar technology provides better interpretation of the scene around a vehicle for the advanced driver assistance system (ADAS) system, enabling for example some Level 2+ (hands off, eyes on) and Level 3 functions (hands off, eyes off) and is crucial to Level 4 and 5 automated vehicles. 4D radar has applications that can be used in everyday situations, in addition to autonomous vehicles.

What new use case brings the first 4D or imaging radar to market?

Consumers and OEMs are demanding greater autonomy, which requires better ADAS features. 4D radar can enable ADAS features such as a highway assist of cruise control and piloting. Highway assist of cruise control which potentially would need to trigger a slow-down braking maneuver requires elevation separation capabilities that only 4D imaging radars can offer. 4D’s ability to classify obstacles as capable of being driven over or not is crucial in engaging highway piloting features that might need to trigger an evasive steering maneuver or a slowdown to avoid damaging the vehicle.

Considering advances in automated driving and autonomy levels, how many 4D or imaging radars do you believe will be required in a vehicle in 2030?

For vehicles in 2030, the number can vary by use case and OEM but typically one to three radars for a passenger car with a driver while robo-taxis could have more and as many as eight.

How can interior radar be utilized for occupant detection and health monitoring within vehicles?

Just to be clear, an interior radar does not have to be 4D. Interior sensing radars can measure respiration rate and reflections, making them highly beneficial for detecting a child or pet left behind even when they might potentially be covered by a blanket or lying in the footwell in the backrow of a vehicle. Interior radars can also assist in intrusion detection.

Can 4D or imaging radars potentially replace or augment lidar sensors? Or are imaging radar and lidar more likely to coexist in vehicles?

Lidars and radars will both be required. Lidars have better angular resolution but require more power and compute. Radars are better in inclement weather. Radars and Lidars would be able to help cameras in very dark situations. While lidars are much less sensitive to inclement weather and lighting than cameras, radars are the least affected by inclement weather. Lidars have much better angular discrimination than radar, and higher resolution. The resulting lidar point clouds have much in common with camera images, which enables similar deep learning approaches to cameras, supporting object detection and recognition, including stationary objects. Additionally, lidars can perceive lane markings, which radar cannot. In addition, radar and lidar would provide sensor redundancy to meet the requirements of L3 levels and higher of autonomous driving.

How does imaging radar compare to traditional radar and to lidar sensors in terms of cost?

For a lidar with greater than 250 meters distance, the price is $500-$650.This distance would compare to imaging radar. There are lidars closer to $200 but they are range limited to 180 meters max.

Imaging and 4D radar sensors are the latest innovations in the storied automotive radar sector, and many automakers are introducing them today and in their next-generation platforms in just a few short years. S&P Global Mobility estimates that production of imaging and 4D radar sensors will grow at a compound annual growth rate of nearly 10% through the end of the decade. To learn more, please visit Component Forecast Analytics or contact your account manager.