The import tariffs aim to protect the North American battery supply chain from cheaper Chinese products, but these tariffs may also hinder access to technologies such as lithium iron phosphate (LFP).

The openness of international markets, amplified by the acceleration in globalization over the past few decades, is usurped by the creeping return of protectionism. Nothing illustrates this trend better than the ongoing tug of war over electric vehicles (EVs) and their related supply chains. Policymakers in the US and European Union are rattled by the ambitions of mainland Chinese companies to expand exports of low-cost EV and EV parts, forcing them to announce new policies and reconsider import tariffs.

In this regard, the US announced some changes in tariffs this month to thwart imports from mainland China. The new tariffs target imports of EVs, lithium-ion batteries, and critical minerals such as graphite and permanent magnets from mainland China. According to the official announcement, in 2024, the tariff on EVs imported from mainland China will increase from 25% to 100%, the tariff on lithium-ion EV batteries will increase from 7.5% to 25%, and the tariff on battery parts will increase from 7.5% to 25%. The new tariffs will take effect on Aug. 1, 2024, the US Trade Representative’s office said on May 22. The tariff on natural graphite and permanent magnets will be increased from 0% to 25%, but not until 2026.

What’s the rationale behind the hikes?

The Biden administration reckons that the new measures were necessary to prevent mainland Chinese companies from flooding the US market with cheaper EVs and batteries, which would make it difficult for American companies to compete. According to a statement released by the White House, the current US government has attracted billions of dollars of investments for the development of a reliable EV supply chain, including batteries and critical mineral, through tax credits under policies such as the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL). The White House implied that the latest increase in tariffs would ensure those investments are protected and can continue as planned.

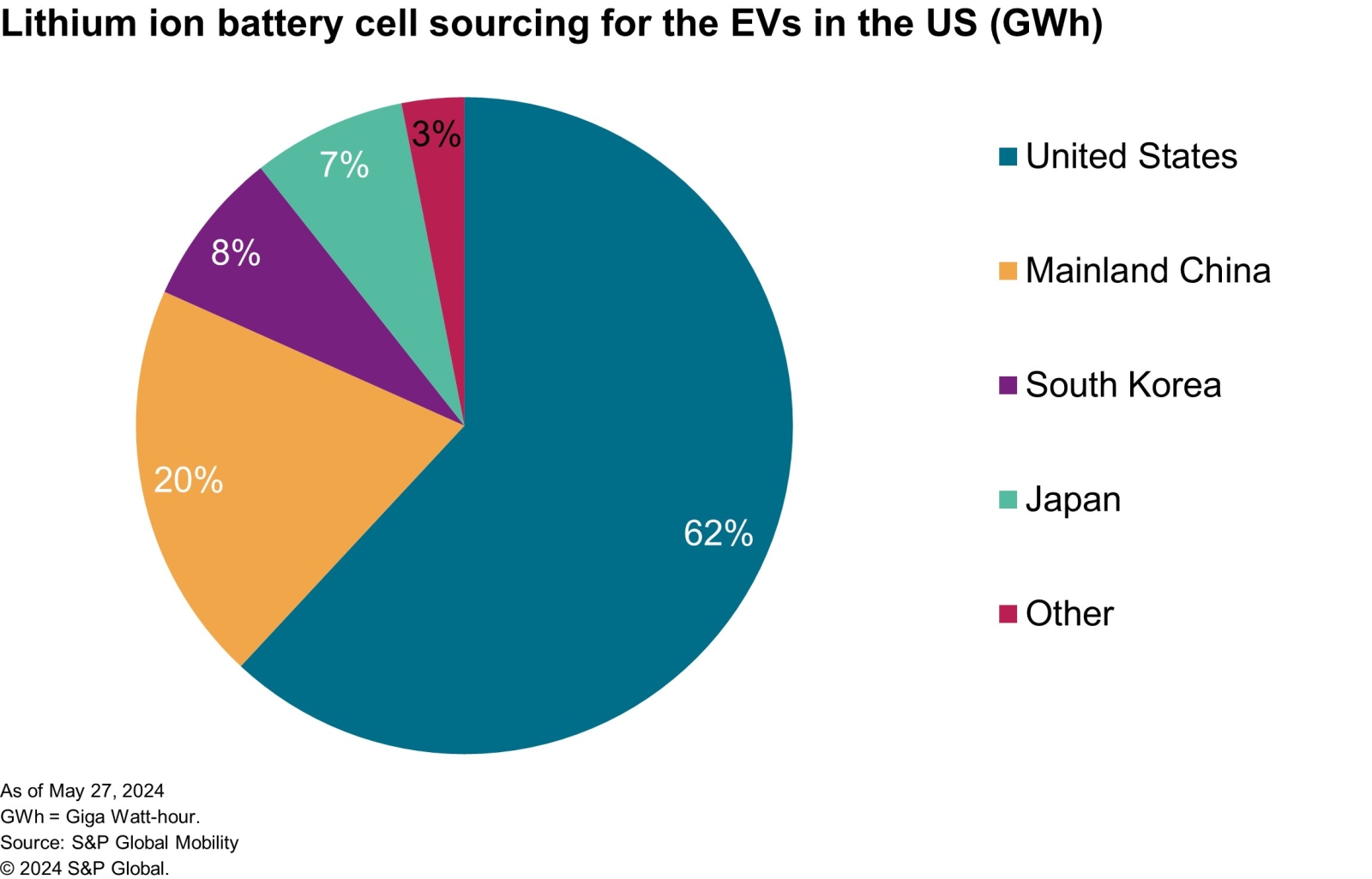

Currently, the US gets most of its lithium-ion batteries from China, but only a small portion of these batteries are for use in EVs. According to S&P Global Mobility’s high-voltage battery forecast, in 2024, based on GWh, about 62% of the lithium-ion battery demand for EVs produced in the US will be met from plants in the US. South Korea and Japan will account for approximately 8% and 7%, respectively. Interestingly, around 20% of the overall demand in the US will be sourced from plants in mainland China.

The current share of mainland China could grow significantly in the future if EV companies in the US find importing from mainland China as a much cheaper option than manufacturing or sourcing batteries locally in the US, discouraging manufacturing of the component in the US.

Actions, reactions and implications

The latest change in tariff rates has come almost five months after the US administration had recognized mainland China as a foreign entity of concern (FEOC) to discourage EV companies from sourcing batteries and raw materials from China-based suppliers. Earlier in December 2023, mainland China had imposed an export control measure on graphite, a critical raw material used in batteries. The move to contain graphite exports was widely seen as a countermeasure to respond to the US’ export restriction for AI chips and semiconductor manufacturing equipment to mainland China.

According to Ali Adim, senior analyst at S&P Global Mobility, “The import tariffs aim to protect the North American battery supply chain from cheaper Chinese products, thereby levelling the playing field for the growing domestic industry. However, these tariffs may also hinder access to technologies such as lithium iron phosphate (LFP), which offers a significant cost advantage over nickel-based chemistries and is predominantly produced in China. Additionally, the IRA disqualifies vehicles with Chinese batteries from tax credits, creating another barrier to adopting LFP technology.

Adim added, “Some American OEMs, like GM and Ford, are exploring domestic LFP production through licensing agreements with Chinese suppliers such as CATL. However, the cost benefits of local production are uncertain due to the lack of an upstream supply chain in North America.”

Rome was not built in a day

With the local content requirements under the IRA and the latest tariff hikes, the US has dealt a double blow to lithium-ion battery imports from mainland China, but it still relies on mainland China directly and indirectly for a range of minerals, including cobalt, graphite and lithium. Mainland China continues to dominate the EV supply chain with more than 80% control on certain segments of the supply chain, including mining and processing of critical minerals. The US government has made progress on onshoring EV component manufacturing, but it takes time for efficient supply chains to form and any retaliatory measure from mainland China like reciprocal tariffs or export restrictions on critical materials could impact the US EV industry in the short term.

Hugo Enrique Cruz, senior analyst at S&P Global Mobility, said, “When comparing the costs of raw materials and operational expenses, it is found that the average price of high-energy NCM lithium battery cells produced in the USA could be 30% higher than the cost-effective LFP batteries manufactured in China. Chinese manufacturers enjoy economies of scale in their factories and have a more integrated supply chain within the country. On the other hand, battery manufacturers in the US face higher costs due to increased energy, labor and permitting expenses compared to their Asian counterparts.”