Batteries are the most expensive component of electric vehicles, with the battery cathode making up roughly one-third of the total cost, due to the usage of critical minerals such as lithium, nickel and cobalt

Amid persistent macroeconomic uncertainty, spot demand for battery metals has waned over 2023, contributing to a general weakening of metals prices, down from record price highs in 2022.

But the horizon for energy transition-related demand has arrived, spurred forward by various government initiatives that have supported plug-in electric vehicle uptake to decarbonize the transport sector and a focus on renewable energy sources.

Batteries are the most expensive component of electric vehicles, with the battery cathode making up roughly one-third of the total cost, due to the usage of critical minerals such as lithium, nickel and cobalt.

Delegates at S&P Global Commodity Insights battery metals workshop in Munich, Germany, held Oct. 25 during the 8th Battery Technologies for EV/HEV 2023 Conference discussed expectations in and recent developments shaping the global battery metals markets.

1. Lithium supply chain at biggest risk of disruption on surging battery demand in long-term

Platts daily spot lithium carbonate and hydroxide prices are hovering around two-year lows, according to S&P Global data, amid cautious purchasing from lithium refiners, who remain focused on procuring from long-term contracts.

The lithium market saw a sharp downturn from peak levels in November 2022 as high prices squeezed consumers' margins and deterred them from the spot market. Demand also slowed due to high supply chain inventories and consumer spending constrained by a weak macroeconomic environment.

The market is currently considered to be in a short-term supply surplus amid better-than-expected progress from eight projects that were due to come online in 2023 located in Australia, Brazil, China and Canada, and two each in Zimbabwe and Argentina.

Despite the recent bearish spot price sentiment, there has been a surge of M&A activity in the lithium market as established players look to buy promising junior miners to secure lithium supply. After all, in the longer-term, the likelihood of supply chain disruptions is much greater for lithium than other key battery metals given most EV batteries will be using lithium-ion chemistries.

S&P Global Mobility has forecast that an over 270% increase of lithium production levels is needed to meet forecast demand from the EV battery sector by 2030.

Nickel and cobalt are also expected to be critical, but at a lesser degree as deployment of iron-based chemistries will remedy their potential shortage.

2. LFP and high-nickel NCM chemistries will be dominant

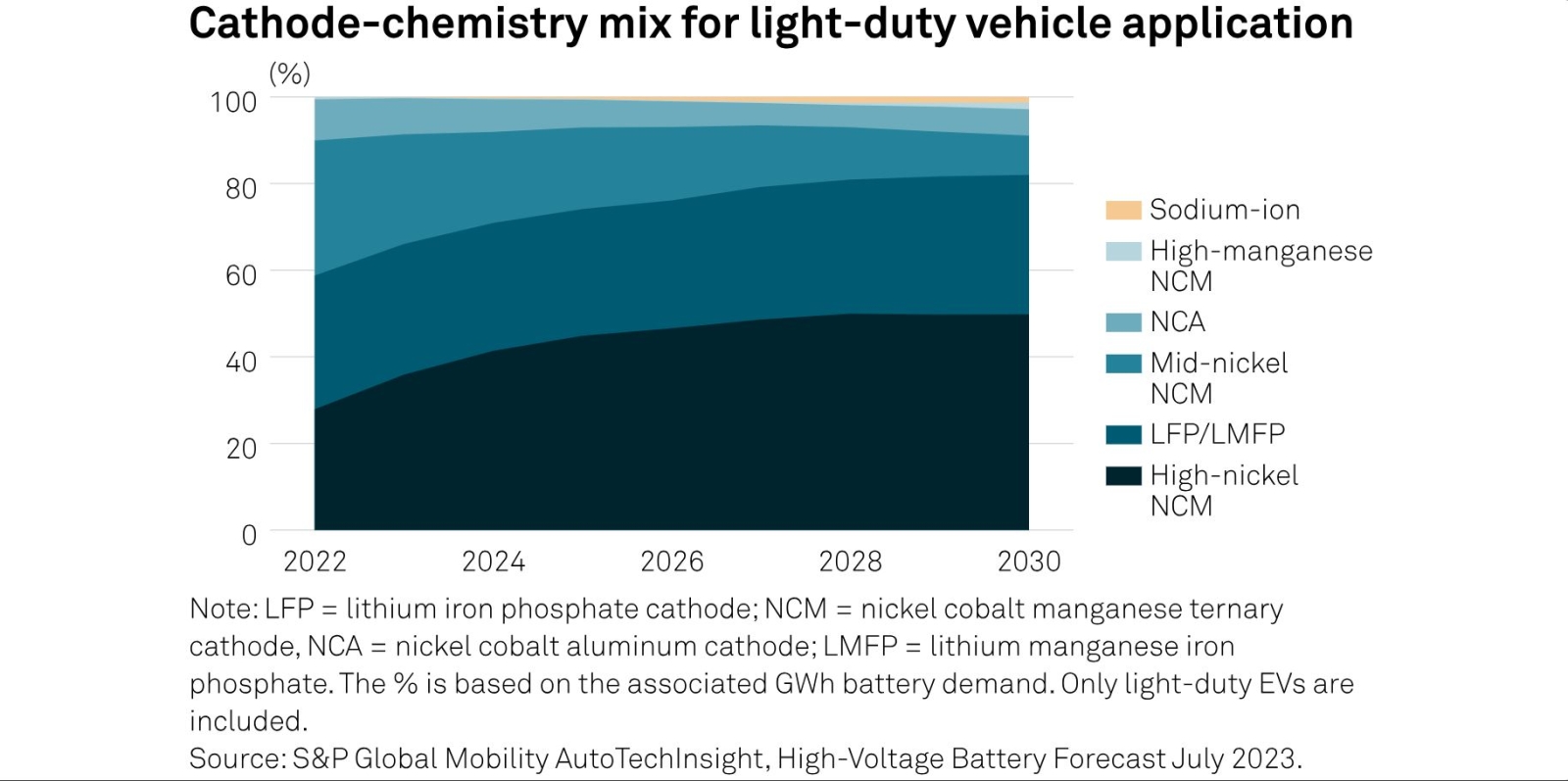

In the longer term, the entry and premium EV segments are consolidating toward two battery chemistries -- lithium iron phosphate, or LFP, and nickel-cobalt-manganese. For light-duty vehicles, high-nickel NCM batteries are forecast to take a near-50% market share by 2030, with LFP and LMFP -- or LFP batteries with a higher manganese component -- taking close to 30% share by 2030.

The volume market, where the largest part of demand resides, will be the battlefield between a few emerging technologies such as advanced LFP such as LMFP, high-manganese NCM and single-crystal NCM, that offer a good combination of cost competitiveness and modest energy density.

In the Chinese market, LFP chemistries -- which currently comprise roughly 70% of the EV market -- are expected to maintain its dominance given its a lower cost advantage. Range anxiety is also less of a concern amid China's better charging infrastructure.

While NCM chemistries are expected to remain dominant in Europe and the US EV markets, LFP and its variations are expected to grow its market share on the back of improved driving ranges and greater mass market EV demand.

Some delegates at the workshop questioned whether fuel cell electric vehicles could be a viable alternative in applications such as public transport or suburban driving, given the forecast of a lithium deficit.

Sodium-ion batteries were also discussed but were expected to comprise a smaller market share of the EV sector going forward, with their lower energy density being a challenge. However, they could be promising for two- and three-wheeled vehicles, with end-users likely to prioritize cost over performance and driving range.

Overall, battery pack sizes are forecast to increase to an average of 75 KWh by 2030, up from 64 KWh in 2023, according to S&P Global Mobility.

3. Oversupply, bearish sentiment to keep pressure on cobalt

The Platts spot European cobalt metal assessment is still hovering around three-year lows, despite an uptick in prices in recent weeks. This was due to a stronger demand for alloy-grade metal as well as some restocking activity from traders.

China's stockpiling body, the National Food and Strategic Reserves Administration, is expected to acquire 3,100 mt of cobalt metal from Chinese refiners in a move to boost its strategic reserve of the critical material over November 2023 to April 2024. This should keep Chinese supply out of the European market for the coming months and will be of some price support.

A surplus in the cobalt market is expected to persist until 2025, with growing supply of cobalt from the Democratic Republic of Congo and Indonesia keeping prices under pressure.

In the salt market, a seasonal spike in consumer electronics demand -- which uses lithium cobalt oxide batteries -- has helped kept cobalt salt prices supported to some degree, although prices for cobalt sulfate, which is used in NCM batteries, are expected to be rangebound on slow NCM demand in China.

For cobalt hydroxide, the Platts CIF China assessment remained flat around $8.5/lb in recent weeks amid lower inventories and tighter spot offers, which were heard as high as $9/lb. Prices remain relatively close to cost of production levels of around $7-$8/lb CIF China on muted downstream demand.

4. EU-Asia black mass trade flow to continue in short-term but second life questions remain

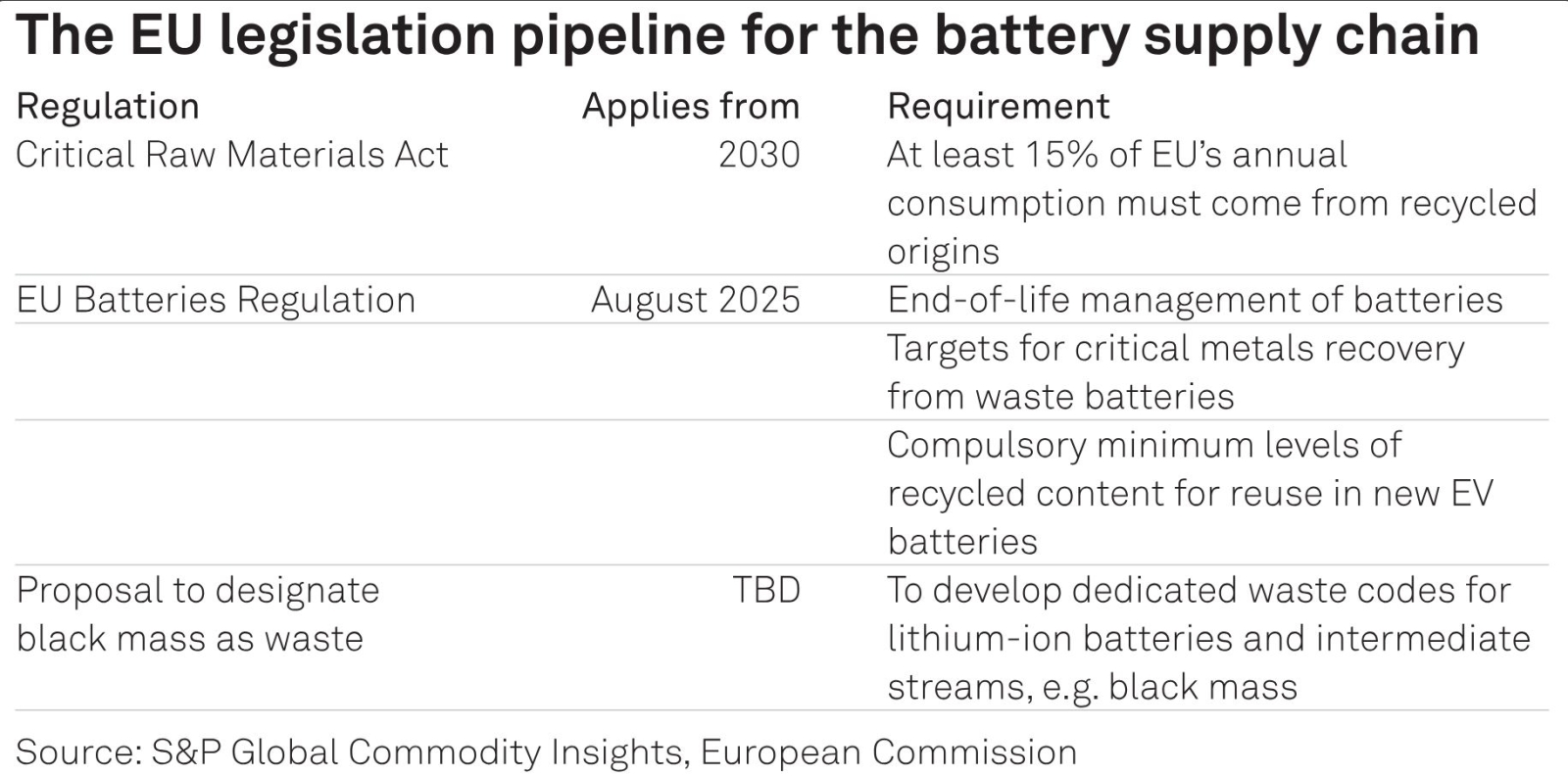

In Europe, several pieces of legislation are in the works to reduce import reliance and improve domestic supply of critical raw materials related to the energy transition.

For black mass, the toxic black powder produced from battery production scrap and end-of-life batteries -- where valuable battery metals such as nickel, cobalt and lithium can be extracted -- a number of different rules will eventually apply.

The proposal by the European Parliament to the European Commission to designate black mass as waste would allow Brussels to classify the material as hazardous waste and restrict its export outside Europe, keeping the contained valuable minerals within European borders. But with the European Parliamentary elections set for June 2024, some market participants do not expect any change to the waste codes until 2025 despite calls for a swifter change to the rules.

Until then, black mass will continue to flow from Europe to Asia, where higher payables can be achieved due to larger recycling capacity in Southeast Asia and South Korea.

Delegates at the workshop also discussed questions surrounding the definition for EOL batteries and what determines whether batteries ends up in second life or being recycled. A common assumption in the market was that as used batteries come to about 80% of original capacity, they can end up in second life, where they may service segments such as energy storage for a few more years.

However, proposed mandates on Extended Producer Responsibility in the EU, which would effectively return EOL batteries to original equipment manufacturers or battery makers, brings to light more considerations that OEMs will take, beyond comparing the value of reuse versus recycle. While there are companies focusing on the production of batteries exclusively for energy storage, there is also a growing market for repurposing in regions where affordability is key.

The lack of standardization on how EOL batteries should be defined could make it challenging to accurately estimate the amount of EOL supply available for recycling, something that OEMs in the EU are increasingly focusing on.

Authors: Viral Shah, Jesline Tang and Ali Adim

S&P Global Commodity Insights metals market coverage, including battery metals and black mass, is global across the Americas, Europe and Asia. Find out more here. Further information on the suite of Platts battery metals assessments is available in the methodology specifications guide.