Strong yen, economic slowdowns in emerging markets seen as major dampeners

Six core Toyota group companies, including Denso, JTEKT, Toyota Boshoku, Toyota Industries, Toyoda Gosei and Toyota Tsusho, are expecting a decline in net sales in the financial year ending 31 March 2017 (FY 2016/17) citing stronger yen and economic slowdowns in emerging markets as the major reasons. For the current financial year, Denso expects a 0.5% y/y decline in net sales to JPY4.5 trillion, JTEKT expects net sales to fall 7.1% y/y to JPY1.3 trillion, Toyota Industries forecasts net sales to lower 1.3% y/y to JPY2.2 trillion, Toyota Boshoku expects sales to decline 6.1% y/y to JPY1.33 trillion, and Toyoda Gosei anticipates net sales to drop 9.2% y/y to JPY710 billion. Only Aisin Seiki has predicted a rise in net sales to JPY3.4 trillion compared with JPY3.24 trillion this year.

Reducing dependence on Toyota and Japan

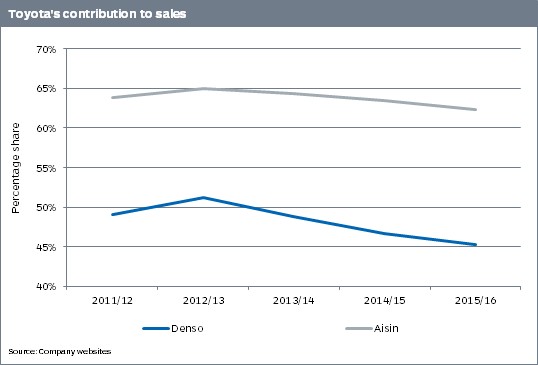

Traditionally, Japanese automakers have relied on their group suppliers under the keiretsu model. This arrangements are currently undergoing dramatic change, as Japanese suppliers react to globalisation of production and purchasing strategies. Many Japanese automakers now have a more diversified supply base comprising both Japanese and non-Japanese customers. Similarly, many core suppliers of Toyota are focusing on reducing their reliance on the automaker and diversifying their customer base to improve profitability and remain competitive. Toyoda Gosei, which has been expanding its non-Toyota customer base, aims to reduce sales contribution of Toyota to 50% by 2020 from approximately 65% in 2014/15. Aisin Seiki is also working on similar lines – Toyota accounted for 62.3% of the company’s total sales in FY 2015/16, down from 63.5% in the previous year. JTEKT too is expanding its non-Toyota customers. In fiscal year 2015/16, the company derived 40% of its total sales from Toyota, down from approximately 50% in FY 2011/12.

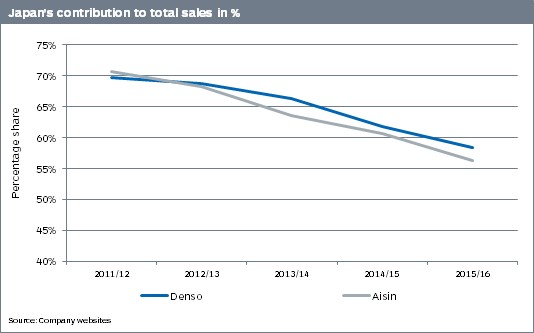

Moreover, a high reliance on the Japanese automotive market is another reason why these suppliers are expecting their revenues to shrink in FY 2016/17. These companies derive a majority of their revenues from Japan. IHS expects light vehicle (LV) sales and production to go down in the country in the coming years mainly due to rise in consumption tax – which was increased from 5% to 8% in April 2014 – and tax on minivehicles. IHS forecasts LV sales to go down from 4.9 million units in 2015 to 4.5 million units in 2020, and LV production to fall from 13.2 million units in 2015 to 12.5 million units in 2020. Given falling revenues in their domestic market, Japanese suppliers are increasingly focusing on expanding their global operations. Denso and Aisin, for instance, have seen their revenues from Japan go down consistently over the past few years. Aisin derived 56.2% of total FY 2015/16 sales from Japan, compared with 70.6% in FY 2011/12 and Denso’s revenues from Japan have fallen from 69.6% in FY 2011/12 to 58.4% FY 2015/16.

Another factor that will drive a decline in sales in FY 2016/17 is the recent earthquakes that hit the country, forcing Toyota to suspend production at most of its factories across the country, and affecting other manufacturers as well. The earthquakes that hit the southern Japanese city of Kumamoto, in Kyushu prefecture, is likely to continue to affect operations for several months at a number of manufacturers and suppliers. Toyota, the hardest hit of the OEMs, is beginning to recover and has already reopened a number of lines and pledged to resume production on all vehicle assembly lines in Japan. In 2016, Toyota hopes to achieve a modest 1% y/y rise in global production volume to 10.19 million units (including its subsidiaries Daihatsu and Hino). The 2016 target for total group production in Japan has been set at 4.13 million units, a rise of 1% y/y.

Analyst Details: Arti Anand