Not all things begin and end with Tesla: Mexico's burgeoning automotive supply chain

25-Mar-2024

As with everything that Tesla says and does, its investment in Mexico for a new vehicle plant has attracted much attention. The latest hubbub around the Santa Catarina, Nuevo Leon, plant surrounds reports that Tesla is looking to invite its mainland Chinese suppliers at its operations in Shanghai to join it in investing in Mexico. That it is looking to bring some of its mainland Chinese suppliers to Mexico is not surprising. Original equipment manufacturers (OEMs) do this all the time. They have their preferred suppliers, and they look to contract with them all over the world. Attracting far less attention, and to the detriment of the Mexican automotive sector, is that Mexico, as an automotive investment destination, is doing very well, with or without Tesla.

In this insight, we will analyze how and why Mexico is doing so well in good time. First, we will address the elephant in the room. S&P Global Mobility has analyzed recent investment announcements by mainland Chinese suppliers where Mexico is the destination. Using our bespoke Component Forecast Analytics (CFA) suite of supply chain data, we have then traced back those suppliers that are engaged with Tesla at its Shanghai facilities.

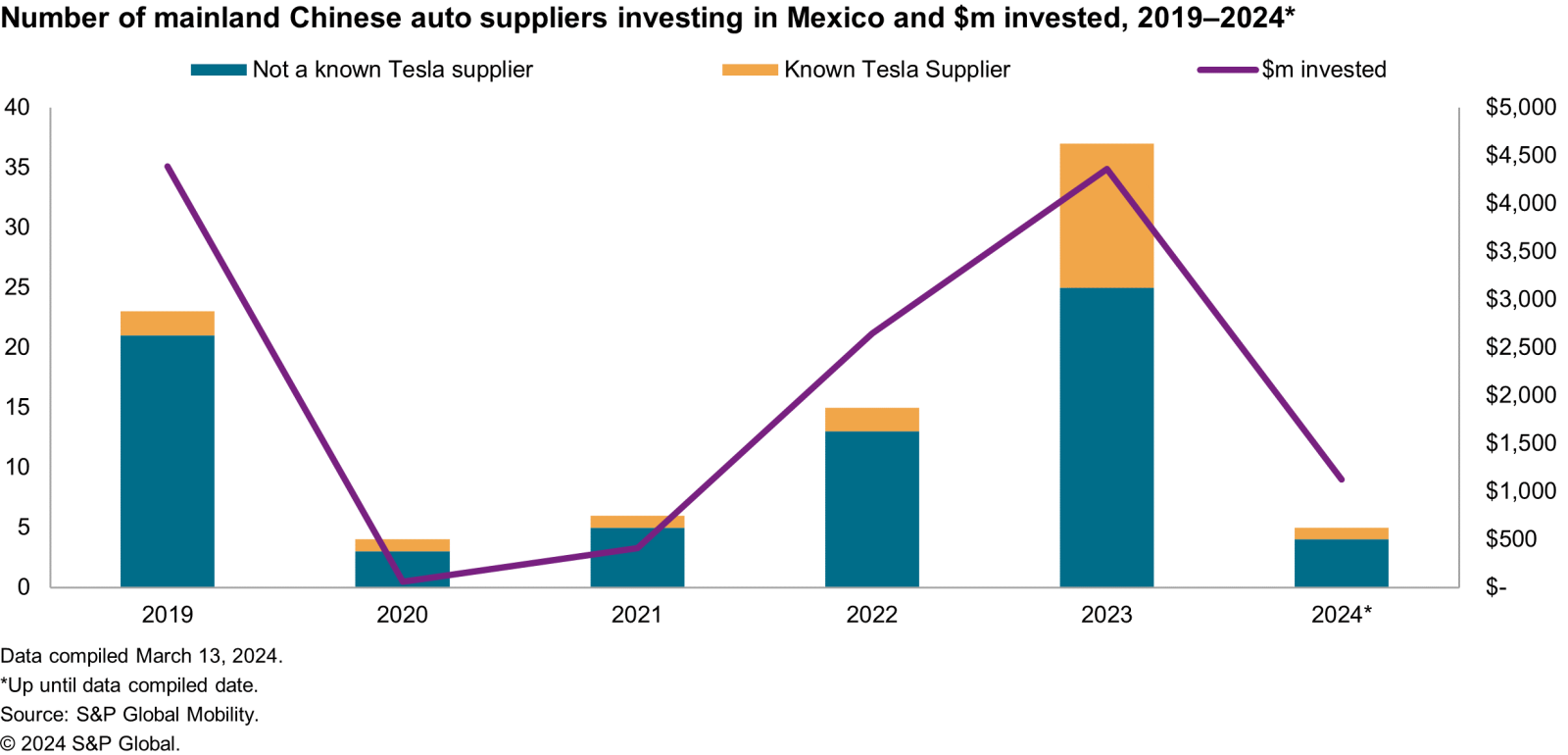

The analysis reveals that out of the 90 investments by mainland China-affiliated automotive companies in Mexico from 2019 until the present, 21 of them, or 23.3% of the companies, are known Tesla suppliers.

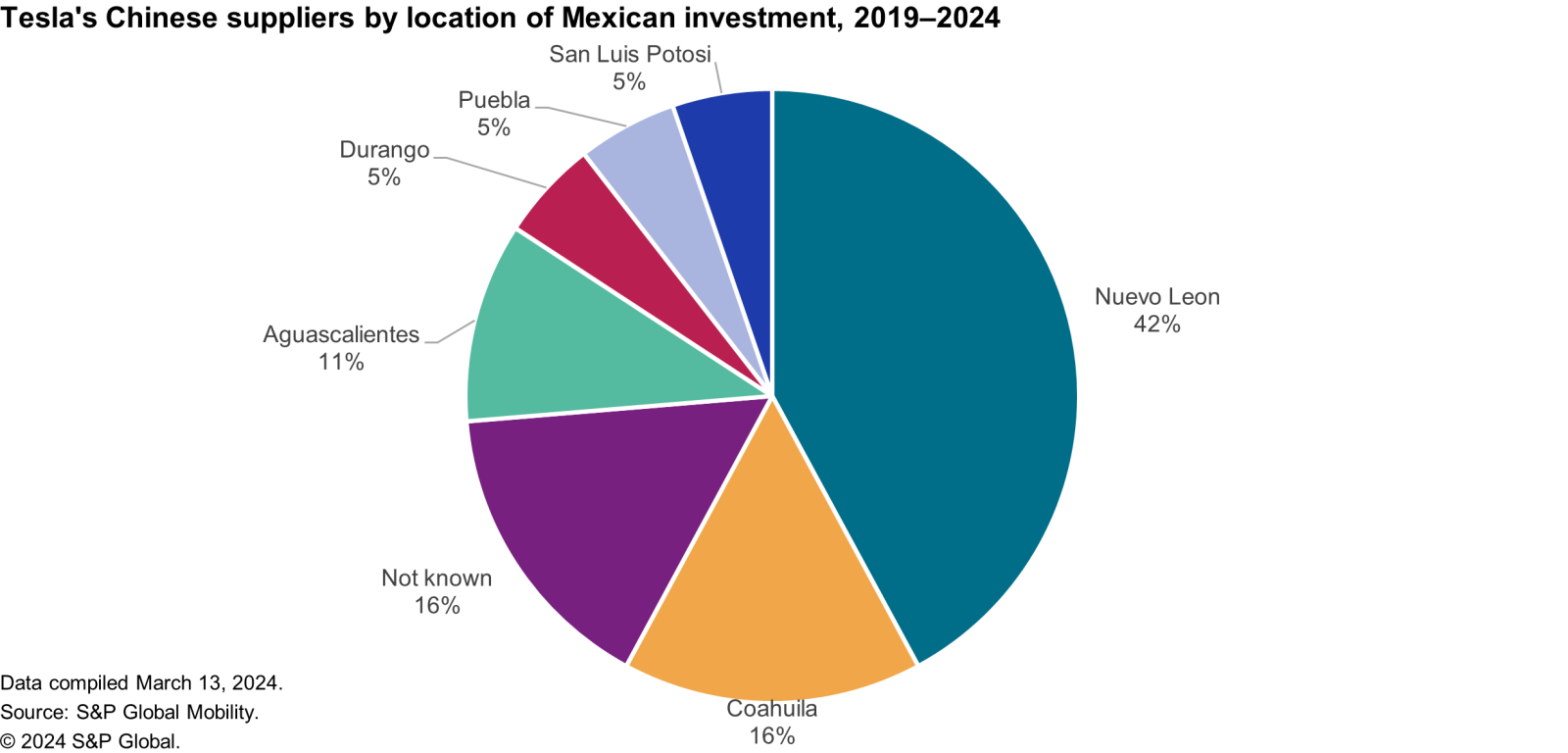

Of course, even if a company is a known Tesla supplier, it does not necessarily follow that those suppliers’ facilities are expressly set up to supply Tesla. This is perhaps best illustrated by the fact that where the investment location is known, only nine of the 21 are setting up in Nuevo Leon, where the Tesla facility will be situated.

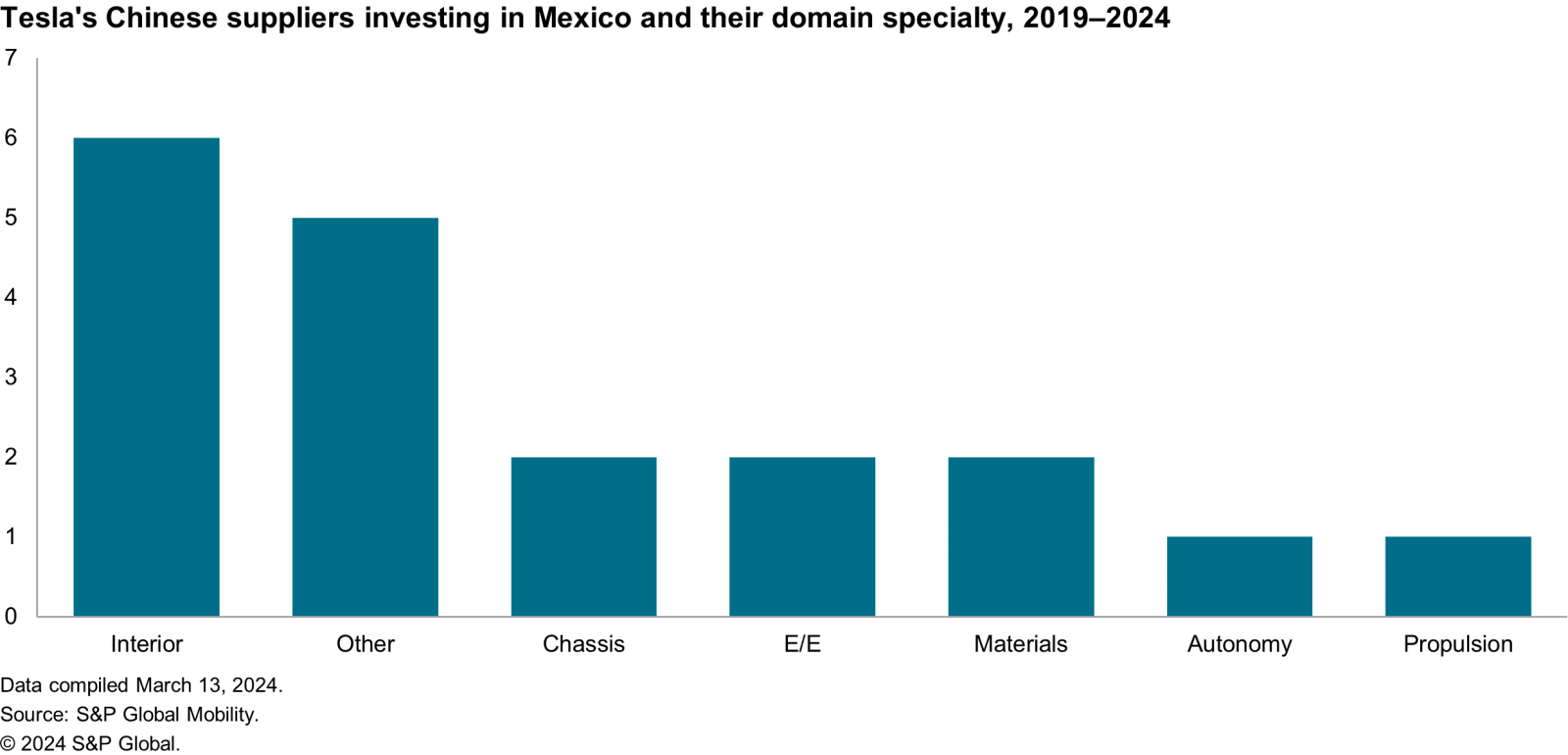

In terms of the vehicle domain that known suppliers spring from, it may surprise that components for electric drivetrains do not feature very prominently. The only identifiable specialist directly involved in battery-electric vehicles (BEVs) is JL Mag, which is investing $100 million in a Salinas Victoria, Nuevo Leon, facility to produce rare earth magnets for BEVs. Just as puzzling is the $260 million lidar specialist Hesai Technology is spending on a lidar facility at Apodaca, Nuevo Leon. Tesla’s eschewal of lidar in its pursuit of autonomous driving is well known. The innocent explanation could be that lidar is required for industrial robots on the shop floor of its Monterey plant. That does beg the question of why build a plant if that is the case. Such robots are likely fixtures and fittings and will not continuously demand the factory throughput to justify a $260-million investment.

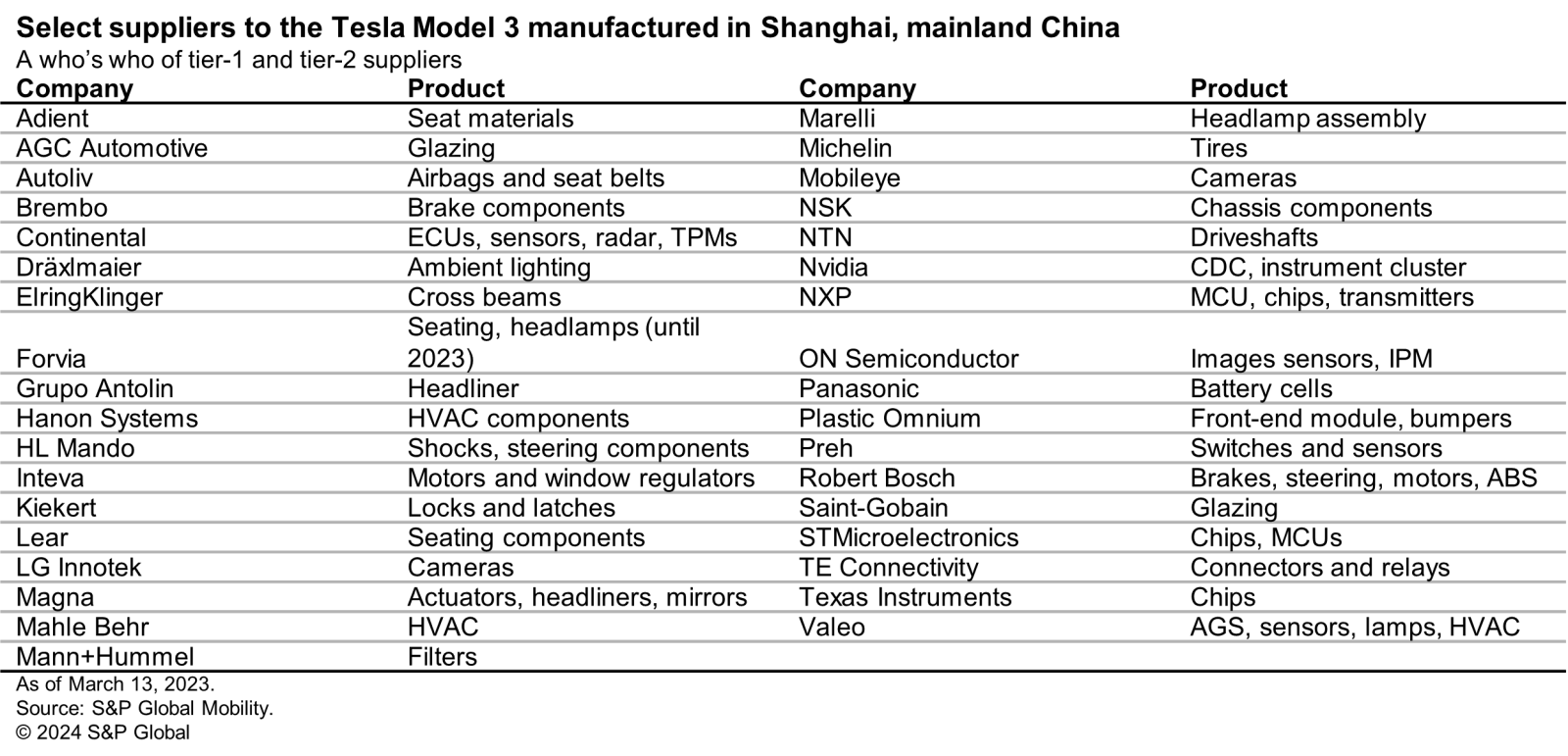

While there is undoubtedly movement in Tesla wanting to ‘lift and shift’ some of its Shanghai supply chain to Monterey, it is not the wholesale replication that has been painted in some quarters. That is because many of its Shanghai suppliers are the everyday suppliers you would see anywhere else in the world with a few exceptions. As is shown below, the select list of suppliers for Tesla’s Model 3 manufactured in Shanghai is a veritable who’s who of Western tier-1 and tier-2 suppliers.

So why the drip-feed of information to the media about Tesla’s plans for Mexico? The Monterey plant is central to the next stage of its growth. It will produce the entry-level car to reach those parts of the demand curve Tesla has never been able to reach and that will go some way to Tesla achieving some of its previously announced volume goals. To achieve a profitable entry-level car, costs have to be controlled (cf. Tesla’s unboxed production system), and Tesla has to keep its suppliers on the right side of its cost projections. What better way to keep supplier costs down than using countervailing power?

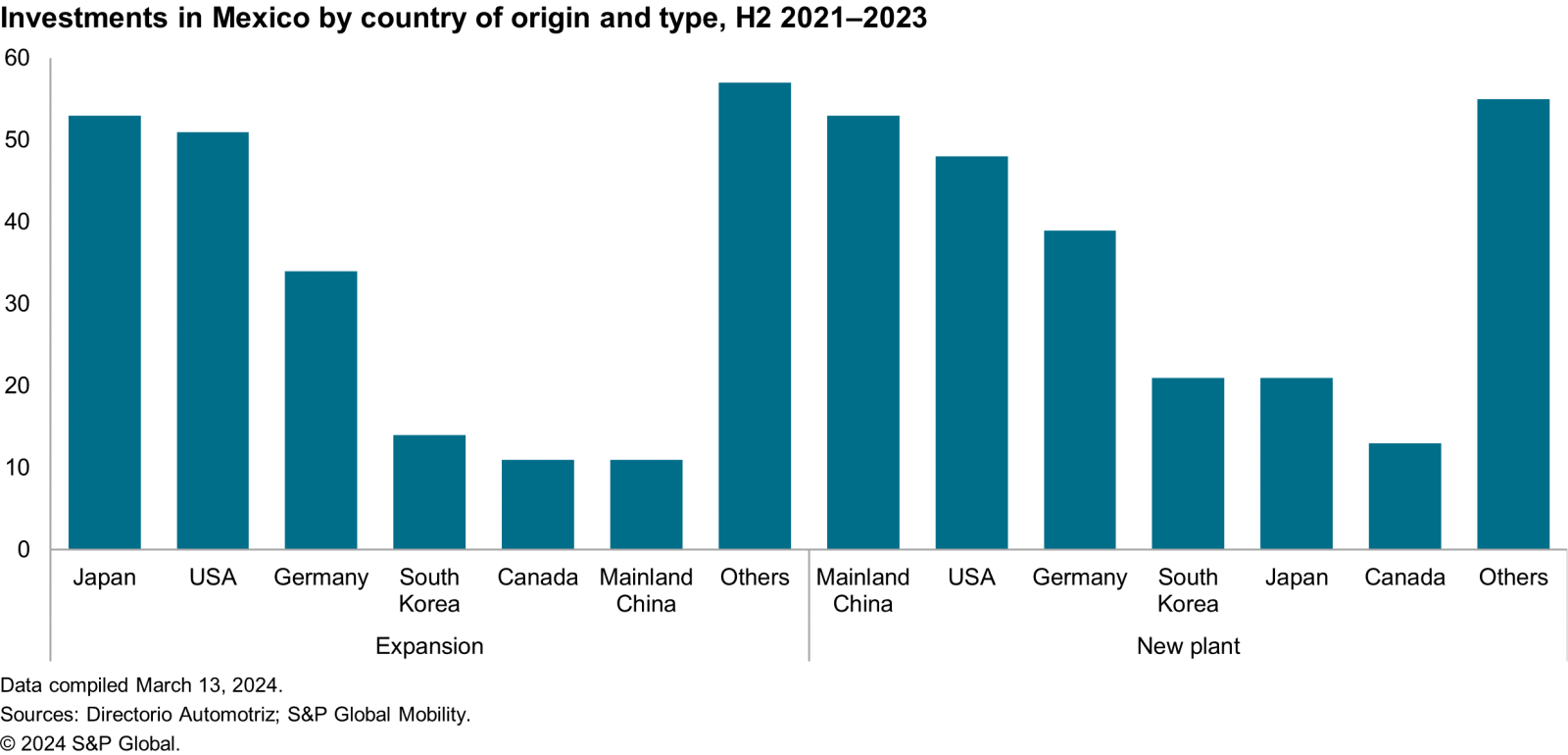

The noise surrounding Tesla’s new plant in Mexico, as well as the prospect of mainland China-domiciled suppliers locating there, actually does Mexico and the wider automotive sector a disservice. Mexico has achieved great success in the recent past in attracting foreign direct investment (FDI) in the automotive sector. Directorio Automotriz, a Mexican public relations agency that acts as a go-between for the various stakeholders involved in setting up shop in the country, tracks investments made in the country’s sector. While the data demonstrates the significant inroads made by mainland China-domiciled suppliers, with the country leading on new plant investments in the past two and a half years, it also shows that there is a much broader base of interest in Mexico currently. Over the period, Mexico attracted $31.9 billion in automotive FDI from 32 separate countries. In domain terms, nearly a quarter of the investments have centered on materials — be it forging, casting or fabricating metals or molding plastics — with the next most populated domain being E/E and semiconductor with a mix of traditional labor-intensive wiring harnesses and more high-tech electronics.

There are obvious reasons as to why Mexico is doing so well as an automotive investment location, not least of them being the reworking of NAFTA to the USMCA free-trade agreement (FTA), which continues to grant Mexico access to the substantial US market on its doorstep. If we want to look more broadly at why a country performs so well in FDI, a good starting point for anyone wanting to look at a country’s competitive advantage in any industry is Porter’s diamond model from his Competitive Advantage of Nations.

From this model, we can see that the everyday factors of production, from basic economics — land, capital, labor and entrepreneur — are not enough to explain a country’s competitive advantage. To the factors, Porter adds: firm strategy, demand conditions, as well as related and supporting industries. All must be supported by government policy that facilitates positive action, with a healthy dollop of luck, or chance as Porter calls it, thrown in.

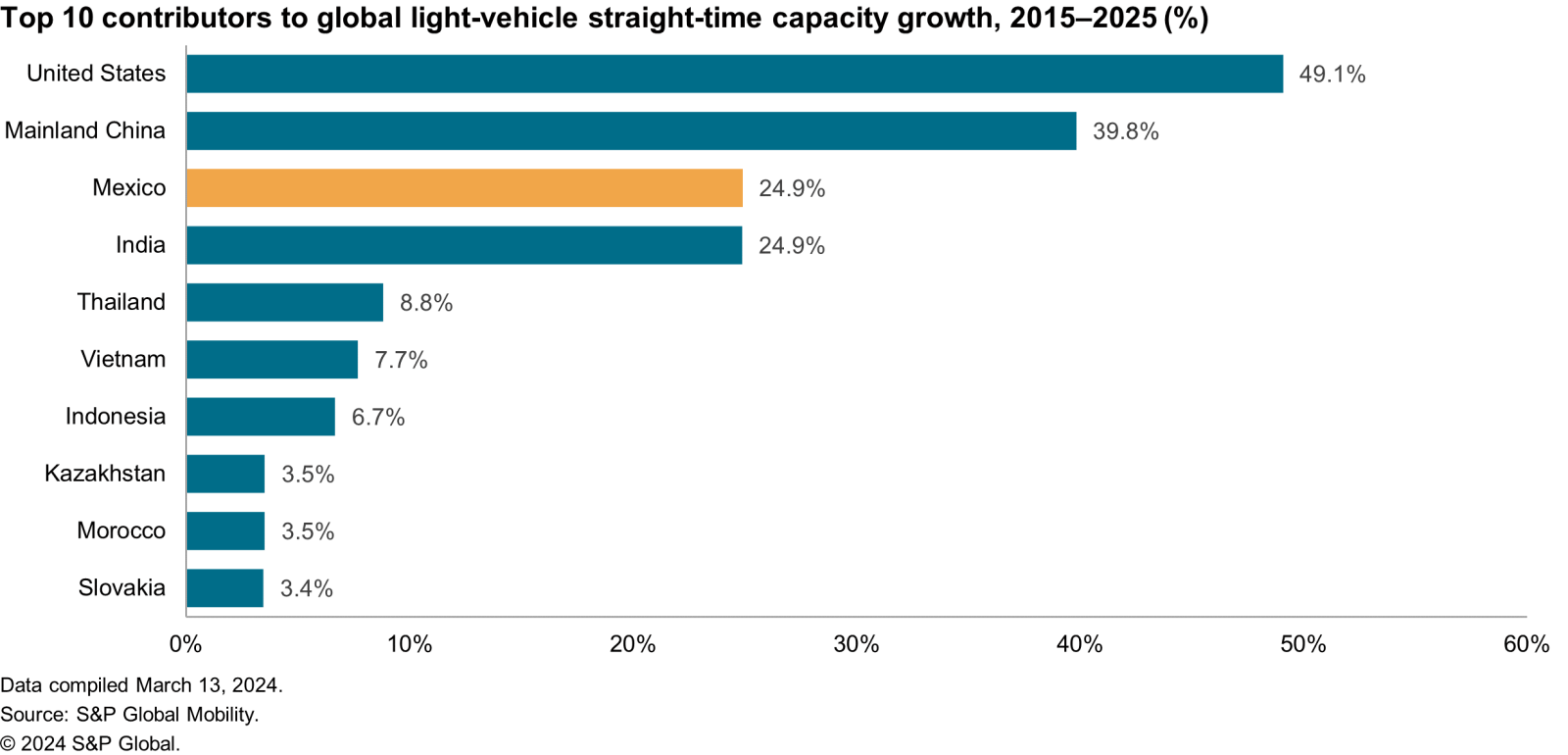

The two biggest factors behind any investment are related to the local market, both in terms of current size and its growth prospects. In this respect, Mexico is well placed due to the number of markets that companies located there have access to. The biggest pull for companies remains tariff-free access to its neighbors, the US and Canada, through the United States-Mexico-Canada Agreement (USMCA). This has proved attractive to OEMs in terms of building vehicle manufacturing capacity in the country, and as we know, where OEMs tread, their suppliers will follow. Between 2015 and 2025, Mexico is set to be the third-biggest contributor of growth to light-vehicle manufacturing globally. According to S&P Global Mobility data, just over 1.9 million units of capacity will be added in the country, which will see Mexico claim 24.9% of total global capacity growth of 7.7 million units.

The data above does not count Tesla. Its Monterey facility is not scheduled to start operations until 2026, when it is expected to register 500,000 units of capacity before rapidly transitioning to a 750,000-unit facility. This again demonstrates that while Tesla has had a significant role in shaping the automotive industry since its inception, it is not always the ultimate arbiter. That is something worth remembering when every Tesla move or pronouncement by Elon Musk is subject to amplification that often goes beyond its significance. Some things, such as Mexico’s ability to attract automotive investment, work just fine without Tesla. For Mexico, Tesla’s decision to set up shop in Monterey is the cherry on top of a cake that benefits from all the right ingredients and has been cooked to near perfection.

- With thanks to Joyce Wang, Tanya Chantiri, Mengyin Tao, Owen Chen, Jie Yang, Quan Zhang, Lyon Zhang, Xukun Yang, Daokuan Lu, Fanni Li, Laura Dong, Eileen Wu and Han Gao all of whom contributed their expertize to this Insight